Samsung VD (visual display) 2022 TV panel procurement plan and strategy From Omdia

The following is the Samsung VD (visual display) 2022 TV panel procurement plan and strategy From Omdia recommended by recordtrend.com. And this article belongs to the classification: Hardware equipment industry.

Although Samsung lowered its TV shipment target in 2021, its panel procurement plan in 2021, especially in the fourth quarter, is still positive. This is based on the current panel price negotiation and the possible response of panel manufacturers to production and supply control.

Samsung has a positive panel procurement plan in 2022, and the strategy of its suppliers may also change significantly. This is based on various considerations, including the dynamic changes of TV supply chain, unpredictable external environmental challenges, Samsung’s high-end TV product planning With the expansion of market competition and the supply of LCD TV panels by a few oligarchs, how should Samsung VD maintain and improve the space for mediation in its supply chain.

main points

Samsung lowered its TV shipment target in 2021, but its panel purchase plan in the fourth quarter of 2021 is still positive. This is based on the current panel price negotiation and the possible response of panel manufacturers to production and supply control.

Based on different situations and strategic considerations, Samsung has an active TV panel procurement plan in 2022.

Even if Samsung display will withdraw from LCD TV panel production next year, Samsung VD, as in the past, still has the strongest influence on the TV supply chain and panel price dynamics, because it has the largest panel purchase quantity in the world and has always adopted the strategy of multi supplier configuration and decentralized order placement. However, from the second half of 2020 to now and even to 2022, Samsung VD’s ability to mediate panel prices may not be as strong as in the past.

Samsung VD needs to find a competitive alternative, but it is not easy because Chinese panel manufacturers dominate all aspects of the current LCD display supply business. Huaxing optoelectronics, Huike and BOE are the largest panel suppliers of Samsung VD, while Youda and qunchuang are still important suppliers. Since 2021, sharp has also become an important strategic supplier, as shown in Figure 2, figure 3 and Figure 4.

In order to reduce the dependence of LCD TV panel supply on Chinese panel manufacturers, Samsung VD may reduce LCD TV shipments in 2022, but shift some product lines to OLED TVs, which can also reduce the purchase of LCD TVs from Chinese panel manufacturers and instead use WOLED TV panels of LG display and Samsung display of Korea QD display panel. Moreover, in addition to continuing to increase the purchase of sharp panels from Japanese LCD TV manufacturers, Samsung VD may also consider significantly increasing the purchase of LCD TV panels from LG display in South Korea in 2022.

However, recently, Samsung VD is negotiating with panel manufacturers to actively purchase a total of 53 million TV panels in 2022. Compared with Samsung VD’s business target of 44 million to 45 million TVs in 2022 (it is unclear whether 2.5 million WOLED / QD OLED TVs are included in this target), it may mean that Samsung VD has considered different schemes and strategies for the 2022 plan.

Samsung VD lowered its TV shipment target in 2021, but the panel procurement plan in the fourth quarter of 2021 was aggressive

In the second quarter of 2021, Samsung purchased more panels than in the first quarter. Since July, Samsung has actively asked its panel suppliers for more price concessions and MDF (market development funds). Panel procurement is Samsung’s bargaining chip to strive for more competitive supply chain resources and prices than its competitors.

Samsung VD’s initial TV shipment target of 49-50 million units in 2021 was forced to be lowered in the first half of this year due to supply chain shortage. In the second half of 2021, the demand for the market slowed down and some of its production disrupted because of its main television production base in Vietnam. Samsung VD once again lowered its target of TV shipments to 44 million units this year.

In the third quarter of this year, TV panel prices reversed and fell rapidly. First tier TV manufacturers, including Korean brands, hope to press the panel prices back to the lowest point of the last round of panel low price cycle at the end of this year in December (such as may 2020). This means that the price rise of LCD TV panel in the past 13 months may reach the lowest point in the low price cycle within 6 months. However, so far, panel manufacturers are not willing to completely compromise.

The recent supply chain survey results show that Samsung’s procurement volume in the third quarter of 2021 is slightly higher than the previous plan, but based on price negotiations and the possible response of panel manufacturers to supply control, Samsung has a strong panel procurement plan in the fourth quarter of 2021.

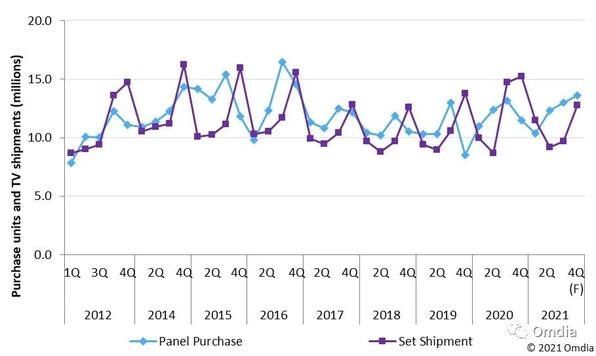

Figure 1: Samsung panel purchases and TV shipments – updated in September 2021

Source: Omdia

Based on different situations and strategic considerations, Samsung has an active TV panel procurement plan in 2022

The panel demand forecast and distribution plan will change from time to time, depending on whether the TV manufacturer can continue to implement its business plan in 2022 or be forced to change the plan due to supply chain problems as in 2021. These uncertainties may lead TV manufacturers to make conservative forecasts for 2022, which will reduce their panel procurement plans. The change of panel procurement plan will also depend on the supply plan of panel manufacturers in 2022.

Despite these uncertainties, TV manufacturers have begun to propose TV business plans for 2022, as shown in omdia TV display and OEM information services. TV manufacturers may adopt a more positive growth rate when formulating the first edition plan in 2022 as one of their strategies to negotiate and compete for panel supply resources.

Recently, Samsung VD is negotiating with panel manufacturers to actively purchase a total of 53 million TV panels in 2022. Compared with Samsung VD’s business target of 44 million to 45 million TVs in 2022 (it is unclear whether 2.5 million WOLED / QD OLED TVs are included in the target), it may mean that Samsung VD has considered different schemes and strategies for the 2022 plan:

Samsung may overbook LCD TV panels as one of its bargaining chips to negotiate more competitive panel supply resources at a lower panel price.

Facing the changeable dynamic phenomenon of the supply chain and the risk of chain disconnection in the future, if we can ensure that competitive panel supply resources are well protected, Samsung may adopt a positive growth plan for its LCD TV shipments in 2022. This is to strengthen its leading position in the global TV market and further expand the competitive territory of Samsung VD market, especially in the large-size and high-end LCD TV lineup.

In 2022, the positive shipment growth of Samsung VD LCD TV may be adopted as an alternative, in case the supply of Samsung display QD OLED panel is not smooth, or if the product planning of WOLED TV is still put on hold in 2022.

Due to COVID-19’s influence on logistics and production, supply chain preparation time (lead time) has been extended to four weeks or more. Considering the risk of global supply chain disruption, Samsung VD may also have to increase their panel supply chain preparation time in 2022.

The uncertainty of supply and demand of display panels is increasing. Samsung may adopt an active panel procurement plan to ensure that its TV display panel supply chain is well managed and minimize the risk of any supply chain interruption of panels and key components used for global TV production.

Samsung VD is worried about the continued loosening of the current LCD TV panel supply, because when low-end TV manufacturers can obtain cheaper panels, it will erode the value of TV panels and stifle TV prices.

In addition to continuing to increase the purchase of sharp panels from Japanese LCD TV manufacturers, Samsung VD may also consider significantly increasing the purchase of LCD TV panels from LG display in South Korea in 2022. This is to reduce dependence on LCD TV panel supply from Chinese panel manufacturers.

Figure 2: Samsung LCD TV panel procurement in 2020, classified by panel supplier

Source: Omdia

Figure 3: Samsung LCD TV panel procurement plan in 2021, classified by panel supplier, updated in September 2021

Source: Omdia

Figure 4: Samsung LCD TV panel procurement plan in 2022 (Preliminary), classified by panel supplier, updated in September 2021

More reading: omdia: Analysis on the change of LCD cycle and demand elasticity between 2008 and 2022 omdia: the application of OLED panels in the computer market will exceed 10 million pieces for the first time in 2021 omdia: it is expected that the global display glass substrate will continue to be in short supply in 2021 omdia: the production capacity of AMOLED in China will be significantly increased in 2021 omdia: in the second quarter of 2020, the shipment of automotive panels reached only 27.9 million pieces, a year-on-year decrease of 33.9% omdia: 3 in 2020 In June, the shipment volume of large-size panels reached 64.16 million pieces of omdia: traditional PON equipment manufacturers ushered in three challengers omdia: 28nm will become a long node manufacturing process for semiconductor applications in the next five years omdia: China’s semiconductor 28nm process is expected to achieve self-sufficiency in the industrial chain within two years omdia: the shortage of large-scale screen display driver chips will be a long-term norm omdia: Global OLED material revenue in 2020 Up to USD 1.259 billion, with a year-on-year increase of 16%. Omdia: in July 2020, the shipment volume of large-size panels reached 79.2 million pieces. Omdia: it is expected that the shipment volume of 4K large-size display panels will reach 148 million pieces in 2020. Omdia: in May 2020, the shipment volume of large-size panels will rise by 16% month on month, reaching a record high of 74.93 million pieces in recent years. Omdia: the supply of curved surface monitoring display panels will decrease sharply from 2021

If you want to get the full report, you can contact us by leaving us the comment. If you think the information here might be helpful to others, please actively share it. If you want others to see your attitude towards this report, please actively comment and discuss it. Please stay tuned to us, we will keep updating as much as possible to record future development trends.

RecordTrend.com is a website that focuses on future technologies, markets and user trends. We are responsible for collecting the latest research data, authority data, industry research and analysis reports. We are committed to becoming a data and report sharing platform for professionals and decision makers. We look forward to working with you to record the development trends of today’s economy, technology, industrial chain and business model.Welcome to follow, comment and bookmark us, and hope to share the future with you, and look forward to your success with our help.