Global Android smartphone AP / SOC sales in 2021 increased by 3.6% year-on-year From Counterpoint

The following is the Global Android smartphone AP / SOC sales in 2021 increased by 3.6% year-on-year From Counterpoint recommended by recordtrend.com. And this article belongs to the classification: Android, Counterpoint, Intelligent mobile phone, Hardware equipment industry.

The smartphone market report recently released by counterpoint predicts that the average price of 5g SOC of smartphone is expected to drop to $20 from the end of this year to the beginning of next year, promoting the popularity of 5g smartphones. Jeff fieldhack, research director of counterpoint research, said that 5g technology has entered the mid-range market with prices ranging from $250 to $550 from the high-end smartphone market with a price of more than $500. Now 5g phones can even be bought at a lower price in some countries.

The average price of 5g SOC falls between $40 and $50. Fieldhack believes that the average price of 5g chip is expected to fall sharply to $20 later this year and early next year, helping mobile phone manufacturers produce low-cost 5g mobile phones at a price of $150.

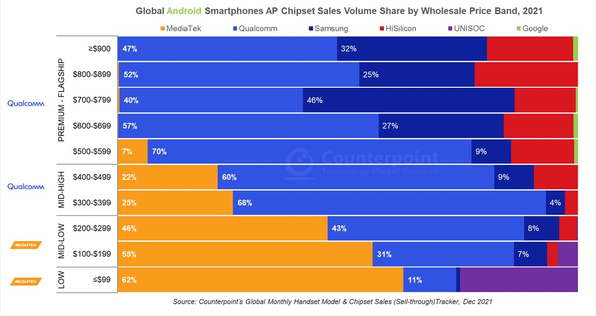

According to the counter point data, the global Android smartphone AP (application processor) / SOC (system on chip) sales increased by 3.6% year-on-year in 2021. MediaTek became the first in the market with 46% market share, followed by Qualcomm with 35% market share. Due to the strong demand for Tianji 700 / 800 Series chipsets, most of the market share growth of MediaTek last year came from medium and low-end models with a wholesale price of less than US $299.

Qualcomm has been struggling to solve the tight supply of mid-range solutions throughout the year. Even if it turns to 4G SOC solution, it can not meet the market demand. In the high-end market of more than $300, Qualcomm continues to dominate with its snapdragon 7 and 8 series. The increase in the number of designs won in Android models of more than $399 has driven its revenue in chipset (AP / SOC) and RF front-end components to continue to rise, and thus won a higher share of BOM.

Figure: Android smartphone AP chipset share by price range in 2021

high pass

Due to the tight supply since last year, Qualcomm will focus on increasing the supply of Xiaolong 7 and 8 series chipsets, and further improve its competitiveness in the high-end market through leading RF front-end product portfolio, ultrasonic fingerprint sensor and fast charging chips.

In 2021, Qualcomm continued to dominate the medium and high-end (US $300-499) smartphone market with a 65% share, up from 53% in 2020. Meanwhile, with the launch of the flagship chipsets Xiaolong 888 and 8gen 1, Qualcomm’s share of the smartphone market above $500 increased from 41% in 2020 to 55% in 2021.

Counterpoint pointed out that Qualcomm is improving the performance experience of chipsets through computing (CPU, DSP, GPU), artificial intelligence (NPU), connection (4G, 5g sub-6ghz, 5g mmwave, wi-fi6 / 6e), security or game performance, and highly optimized RF front-end components are the key to providing advanced connection experience, which has become a major competitive advantage of Qualcomm at the system level.

Looking forward to the future, diversified OEM strategy will be the key to alleviate concerns about chip shortage.

MediaTek

The growth of MediaTek in 2021 mainly comes from the smartphone market below US $299 (wholesale price). The market below $99 is driven by LTE smartphones, of which MediaTek accounts for 62% of the market share. In the Android smartphone market between us $100 and US $299, MediaTek dominates the market with a 52% share, mainly thanks to the promotion of the mass 5g smartphone market by Tianji 700 and 800 in China, India, the United States and some parts of Europe, which enables brands such as realme, Xiaomi, oppo and vivo to launch 5g phones at a retail price of less than US $200.

Tianji 1100 / 1200 helped MediaTek increase its share in the price range of $300 ~ 499, and its market share increased from 6% of the previous year to 24% in 2021. Tianji 8100 / 8000 and its launch are expected to strengthen its market share in this range. With Tianji 9000, MediaTek hopes to enter the high-end market of more than $500 in 2022. Almost all Chinese smartphone OEMs, including oppo, vivo, Xiaomi and glory, will launch models equipped with the chipset. Counterpoint predicts that MediaTek is expected to occupy about 10% of the high-end smartphone market.

Samsung

Samsung’s smartphone SOC share experienced a decline in 2021.

In the middle and low-end market of $100 ~ 299, Samsung SOC’s share fell to 7% from 17% the previous year. In the medium and high-end market, it fell from 13% in the previous year to 6% in 2021.

Counterpoint pointed out that it is mainly because Samsung Mobile has outsourced many of its models (a, F and M Series) to ODM, which mainly uses the solutions of Qualcomm, MediaTek or zhanrui; The absence of SOC update of medium and high-end exynos series is the incentive for ODM to turn to other solutions. The absence of the note series and Qualcomm’s design advantages in Samsung’s foldable products led to a further decline in the share of exynos chipsets.

With the galaxy S22 series, Qualcomm has won a higher proportion of designs in the market than ever before, mainly due to Qualcomm’s leadership in products and the low yield of Samsung exynos chipsets.

Zhan Rui

In 2021, zhanrui achieved surprising growth in the smartphone market in the price range below $200. In 2020, zhanrui chipset only faces the market below US $100. By 2021, realme, glory, Motorola and Samsung have launched mobile phones equipped with their tiger series SOC. The customer base has been greatly expanded, adopted in ZTE and Tecno, and entered Samsung Galaxy a series.

According to the data, in 2021, zhanrui gained 26% market share in the market below US $99 and 4% market share in the market between us $100 and US $199.

Counterpoint expects zhanrui to maintain its growth momentum this year, and its product portfolio will make up for the demand of LTE smartphone market, because MediaTek is solving the supply problem in this field, while Qualcomm is more focused on 5g solutions. In addition, some design options obtained by zhanrui’s 5g chipset will increase overall sales.

Hisilicon

Due to the ban of the United States, the share of Hisilicon SOC in the smartphone market above $500 in 2021 fell sharply to 16% from 30% the previous year, and was still based on the inventory prepared before the ban came into effect.

Counterpoint predicts that in 2022, the sales volume of Hisilicon SOC will decline further with the depletion of inventory. Huawei has begun to use Qualcomm SOC in its new models, but it is limited to 4G solutions.

Self-contained microgrid

More reading: Counterpoint: the competition intensifies, and the gap between MediaTek and Qualcomm is gradually narrowing. Strategy Analytics: in 2021, the shipment volume of Q3 tablet application processor decreased by 14%. Strategy Analytics: in 2021, the revenue of Q3 global cellular baseband market reached US $8.15 billion, an increase of 23.3%. Ann rabbit: 2014 global mobile phone chip brand distribution and popular ranking IC insight: chip design sales are expected in 2010 The total amount is 41.4 billion US dollars. Strategy Analytics: in Q1 2014, the global cellular baseband chip market reached 4.7 billion US dollars. Counterpoint: it is estimated that iPad sales using M-series Apple self-developed chips may reach 20% in 2022. Counterpoint: it is estimated that the CIS market will reach 21.9 billion US dollars in 2022, and Samsung will further narrow the gap with Sony. Counterpoint: in Q1 2017, the shipment of medium and high-end smartphones increased by 49% counterpoint : in 2017, Huawei ranked third in the global smartphone shipment ranking with a 10% share. Strategy Analytics: in 2021, the shipment volume of Hisilicon in Q1 plummeted 88% year-on-year. IC insights: in the first half of 2020, the global semiconductor sales ranked among the top 10 manufacturers. Counterpoint: in 2021, the market share of Xiaomi in Q3 European smartphone market rose to the second with 15.5%. Counterpoint: in 2021, apple dominated the global smartphone market profit in Q2 Accounting for 75% of counterpoint: it is estimated that the global smartphone shipment will be 1.41 billion in 2021, down to an estimated annual growth of 6%

If you want to get the full report, you can contact us by leaving us the comment. If you think the information here might be helpful to others, please actively share it. If you want others to see your attitude towards this report, please actively comment and discuss it. Please stay tuned to us, we will keep updating as much as possible to record future development trends.

RecordTrend.com is a website that focuses on future technologies, markets and user trends. We are responsible for collecting the latest research data, authority data, industry research and analysis reports. We are committed to becoming a data and report sharing platform for professionals and decision makers. We look forward to working with you to record the development trends of today’s economy, technology, industrial chain and business model.Welcome to follow, comment and bookmark us, and hope to share the future with you, and look forward to your success with our help.