In 2021, the sales volume of the global high-end smartphone market increased by 24% year-on-year, the highest ever From Counterpoint

The following is the In 2021, the sales volume of the global high-end smartphone market increased by 24% year-on-year, the highest ever From Counterpoint recommended by recordtrend.com. And this article belongs to the classification: Android, iOS, iPhone, Intelligent mobile phone.

According to the market pulse service (monthly report on mobile phone sales) data of counterpoint research, compared with the 7% growth rate of global smart phones in 2021, the market sales of global high-end smart phones (with an average wholesale price of more than US $400, about RMB 2540) last year increased by 24% year-on-year, the highest in history, and the growth rate exceeded the overall smart phone market. It is worth noting that the 27% share of the high-end market in the global smartphone market has also reached an all-time high.

Share of global high-end smartphone market in 2016-2021

Source: counter point global monthly handset model sales (sell through) tracker

Commenting on the growth performance of the high-end smartphone market in 2021, Tarun pathak, research director, said: “In 2021, a variety of factors have driven the growth of the high-end market, including the replacement demand for high-end mobile phones, the strategic decisions of mobile phone brand manufacturers and the dynamic characteristics of the supply chain. The iterative demand of emerging economies for the entry-level high-end market and the demand of developed countries to upgrade to 5g devices continue to drive the growth of the high-end market. Especially in China and Western Europe, including apple (AAPL. US), oppo, vivo and Xiaomi (01810) OEMs including Huawei have actively seized the gap in the high-end market left by Huawei, which has promoted the growth of this part of the high-end market. In the current difficult period of the supply chain, considering the improvement of profit margin and profitability, manufacturers in the mobile phone ecosystem will also give priority to the supply of high-end equipment. In addition, the growth rate in 2021 is also related to the impact of COVID-19’s mobile phone sales and marketing plan in 2020.

In terms of mobile phone brand manufacturers, due to the significant upgrade of iPhone # 12 and phone 13 series in 5g, Apple has reached 60% sales share for the first time since 2017 and continues to lead the market. The delayed release of Apple’s mobile phone in 2020 also pushed this demand to 2021. With its strong brand power, apple is most likely to seize the users of Huawei’s high-end smartphones, which is also confirmed by its growth performance in the Chinese market: Apple reached the highest market share ever in the fourth quarter of 2021. Not only that, apple is the top OEM in the high-end mobile phone market in every region in 2021.

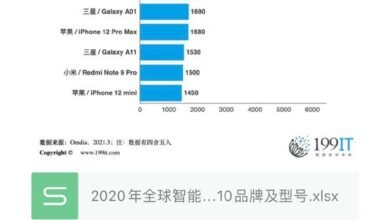

Sales share of global high-end smartphone brands in 2020 and 2021

Source: counter point global monthly handset model sales (sell through) tracker

Samsung’s sales in the field of high-end smart phones increased by 6% year-on-year, but its overall share decreased. The performance of S21 is better than that of S20 impacted by the new crown. In the second half of 2021, the Z-fold series was launched in Korea, Western Europe and North America, especially in the second half of 2021. However, the lack of new note series and Fe series updates in 2021 also offset the company’s overall gains in this regard. Similarly, the shortage of parts has also affected the supply of mobile phones.

In 2021, the sales of oppo and vivo in the high-end market more than doubled to 116% and 103% respectively, which helped them rank among the top five in the high-end market in many regions. Reno’s brand reshaping in early 2021 helped oppo occupy China’s entry-level high-end market. Aiming to fill the market vacancy left by Huawei, oppo’s performance in the European market has also increased steadily. The growth of vivo is driven by the X60 and X50 series sold in China and Southeast Asia.

Xiaomi’s sales growth is driven by the mi11 series, which ranks among the top five in the high-end markets in all regions with sales. ASUS also achieved sales growth by focusing on mobile phones in the niche game field. The share growth of Motorola, Google and Yijia in the North American market was affected by LG’s withdrawal from the smartphone market.

Ranking of global mobile phone brand manufacturers by region and high-end mobile phone market in 2021

Source: counter point global monthly handset model sales (sell through) tracker

In terms of cellular access technology, 5g has become the standard configuration in the high-end market, but 4G continues to occupy a place in the market driven by the earlier iPhone (11 and Se 2020) and Samsung S20 Fe. However, with the transformation of these product lines to 5g in 2022 and the beginning of entering the developing regional market, LTE’s share will further decline. However, Huawei will continue to launch new mobile devices with LTE function.

5g and 4G share of high-end mobile phone market

Source: counter point global monthly handset model sales (sell through) tracker

Senior analyst Varun Mishra said in commenting on the outlook of the high-end market: “Looking forward to the future, driven by the iterative demand of the market, the high-end smartphone market may continue to grow and exceed the growth rate of the global smartphone market. Another important opportunity to promote the high-end market is the holding of Huawei’s high-end phones in China, which is close to the replacement cycle. The competition in China’s high-end market has always been fierce, but Huawei’s second place in 2021 also indicates the future of other mobile phone manufacturers Opportunities. In addition, the introduction of foldable mobile phones at a lower price than before will also promote the growth of the high-end market. Samsung has regarded foldable mobile phones as an independent market. Apple’s foldable phone will prove the robustness of the technology and further drive growth. “

More reading from Zhitong Finance: Counterpoint: 2018 report on India’s high-end smartphone market counterpoint: in 2021, Q2, the global high-end smartphone Apple sales accounted for 57% counterpoint: in 2020, Q1, the global high-end smartphone market, Huawei’s market share was 12%, ranking third counterpoint: in 2018, Q2, the global mobile phone oppo ranked first with us $400-600, counterpoint research: in 2019, Q3, the global high-end smartphone market, Apple’s share was 52%, computerpoint: 201 Q3 high-end mobile phones grew by 19% in 8 years. CMR: Samsung’s share in India’s high-end mobile phone market reached 48% in the first half of 2018. Counterpoint: Apple’s sales of global high-end smart phones accounted for 70% in December 2016. Strategy Analytics: it is estimated that the revenue of high-end smart phones will account for 80% of the total revenue of smart phones in Western Europe in 2021. Nelson: the overall share of medium and high-end smart phones in the first half of 2016 will reach 47.59%. Samsung Mobile: Samsung’s shipment of high-end models is only one-third of Apple’s Mr India: India’s high-end smartphone market grew by 53% in 2015. CMR India: India’s high-end smartphone market is expected to grow by 19% in 2016. Emarketer: Chinese smartphone brands account for an increasing share of India’s high-end phone market. Gartner: the global smartphone IOS share fell to 12.9% in Q2 in 2016, and iPhone sales fell for three consecutive quarters

If you want to get the full report, you can contact us by leaving us the comment. If you think the information here might be helpful to others, please actively share it. If you want others to see your attitude towards this report, please actively comment and discuss it. Please stay tuned to us, we will keep updating as much as possible to record future development trends.

RecordTrend.com is a website that focuses on future technologies, markets and user trends. We are responsible for collecting the latest research data, authority data, industry research and analysis reports. We are committed to becoming a data and report sharing platform for professionals and decision makers. We look forward to working with you to record the development trends of today’s economy, technology, industrial chain and business model.Welcome to follow, comment and bookmark us, and hope to share the future with you, and look forward to your success with our help.