It is estimated that the annual growth of global foundry output value will reach 23.8% in 2020 From TrendForce

RecordTrend.com is a website that focuses on future technologies, markets and user trends. We are responsible for collecting the latest research data, authority data, industry research and analysis reports. We are committed to becoming a data and report sharing platform for professionals and decision makers. We look forward to working with you to record the development trends of today’s economy, technology, industrial chain and business model.Welcome to follow, comment and bookmark us, and hope to share the future with you, and look forward to your success with our help.

The following is the It is estimated that the annual growth of global foundry output value will reach 23.8% in 2020 From TrendForce recommended by recordtrend.com. And this article belongs to the classification: TrendForce, Hardware equipment industry.

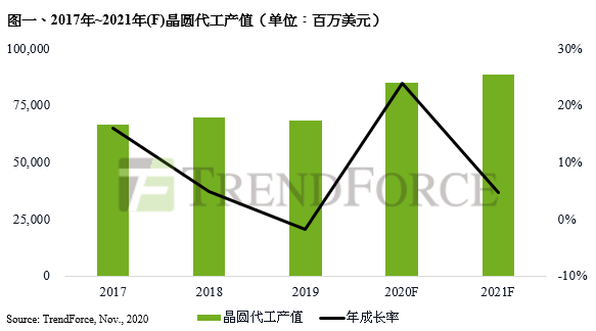

According to the semiconductor research office of trendforce Jibang consulting, the epidemic in 2020 will cause many industries to be impacted. However, thanks to the new normal of remote office and teaching, the penetration rate of 5g smart phones and the strong demand for related infrastructure, the global semi conductor industry will rise against the trend. It is estimated that the annual growth rate of global foundry output value will reach 23.8% in 2020, a breakthrough The peak in recent ten years.

Judging from the order receiving situation, the tight production capacity of semiconductor OEM is expected to last at least until the first half of 2021. In terms of advanced processes below 10nm level, TSMC and Samsung are at nearly full capacity at this stage, and 4 / 3nm processes will come out in the next year. As a result, ASMA’s EUV equipment has become a scarce resource that every wafer factory is eager to compete for To expand production capacity in advanced process. In addition, the production capacity of the process above 28nm is supported by many requirements such as CIS, sddi (small size display driver chip), RF radio frequency, TV chip, WiFi, Bluetooth, TWS, etc., and the emerging applications such as WiFi 6 and AI memory heterogeneous integration help, the production capacity is also increasingly in short supply.

It is worth mentioning that since the second half of 2019, 8-inch production capacity is hard to obtain. As there is almost no supplier to produce 8-inch equipment, the price of 8-inch machine is rising rapidly, while the price of 8-inch wafer is relatively low. Therefore, it is generally not cost-effective to expand 8-inch production. However, for example, PMIC (power management chip), lddi (large-scale display driver chip) and other products are in the 8-inch range However, it is most cost-effective to produce in inch factory, and there is no need to move to 12 inch or even advanced process. In the 5g era, the demand for PMIC, especially in smart phones and base stations, grew exponentially, resulting in the limited production capacity in short supply. Although some products had the opportunity to be gradually transferred to 12 inch factories, it was still difficult to relieve the market situation of 8-inch demand shortage in the short term.

TSMC is actively expanding its 5nm process and will cover nearly 60% of the market share of advanced process by the end of 2021

Looking at the most advanced 5nm process at present, after TSMC was restricted by the U.S. ban on Hisilicon under Huawei, only apple is the only customer for the 5nm process that was mass produced in early 2020. Even if Apple actively introduces its own MAC CPU and FPGA accelerator card applied to servers, its total chip size is still difficult to fully make up for the vacant capacity of Hisilicon, resulting in the 5nm production rate falling to about 85-90% in the second half of this year. Looking forward to 2021, in addition to Apple’s continuous production of A15 bionic with 5nm +, amd 5nm Zen 4 architecture products will also start small-scale trial production, supporting the 5nm acceleration rate of 85 ~ 90%.

It is worth mentioning that from the end of 2021 to 2022, including MediaTek, NVIDIA and Qualcomm, have plans for mass production of 5 / 4nm products, together with AMD With the large volume of zen4 architecture and the outsourcing production of Intel CPU, it is estimated that 5nm process will be adopted first in 2022. The huge demand has prompted TSMC to start the 5nm expansion plan. According to the current observation, it is very likely that Apple will continue to use 4nm (5nm miniaturization process) to produce a16 processor in 2022. At that time, it is not ruled out that TSMC will further expand its 5nm production capacity to support Support the strong demand of customers. On the other hand, although the GPU of NVIDIA hopper geforce platform will continue to be contracted by Samsung, and with the support of Qualcomm snapdragon 885 and Samsung exynos flagship series, Samsung has plans to expand its 5nm production capacity in 2021, but there is still a gap of about 20% compared with TSMC.

Based on the above, in recent years, united power and lattice core have successively withdrawn from the advanced manufacturing process competition. Leaving aside SMIC international, which has been plagued by the US shipment ban recently, only TSMC and Samsung compete with each other at nodes of 7Nm and below. From the perspective of customers, after winning NVIDIA’s big order, Samsung also actively expanded its 5nm capacity in pingze new plant. However, as it entered 2022, as the high possibility of adopting TSMC 4nm in the plan of Qualcomm snapdragon 895, Samsung would only have NVIDIA and Samsung (LSI) as its main customers. In contrast, TSMC, in addition to apple, AMD, MediaTek, NVIDIA and Qualcomm, has more opportunities to obtain Intel CPU Outsourcing is favored. According to trendforce, the 5nm demand of TSMC will be relatively stable and strong in 2022, and the 3nm process will be mass produced in the second half of 2022, which is expected to further boost its market share.

More reading: cinno research: Q1 wafer foundry will decline by 20% in 2019, and the output value of packaging and testing will decrease by 16%, 3.3 million tablets 17.7% year-on-year growth trendforce: server semi-finished product inventory is high, and overall order momentum in the third quarter of 2020 is facing correction. Trendforce: the estimated annual growth rate of LCD shipment in 2020 is 37% trendforce: coronapneumonia officially enters the pandemic, and global system risk will impact the storage industry. Trendforce: the short-term supply shortage of large-scale DDI is relieved, and trendfor may reappear in the second half of the year CE: in 2015, the total output value of DRAM in Q4 was 10.27 billion US dollars, with a decline of 9.1% on a month on month basis. Trendforce: the revenue of top 10 sealing and testing companies in Q3 of 2019 is estimated to be $6 billion, with an annual increase of 10.1%. Trendforce: the revenue of NAND flash manufacturers in the third quarter of 2019 will reach about $11.9 billion Top 10 IC design companies in the world in the first quarter of 2020 trendforce: DRAM spot price has been rising for a long time, but DRAM price is still under pressure in the second half of this year More than 12 million units

If you want to get the full report, you can contact us by leaving us the comment. If you think the information here might be helpful to others, please actively share it. If you want others to see your attitude towards this report, please actively comment and discuss it. Please stay tuned to us, we will keep updating as much as possible to record future development trends.