Enterprise Research Report of hotel industry in 2019 – Oyo From Dongxing Securities

RecordTrend.com is a website that focuses on future technologies, markets and user trends. We are responsible for collecting the latest research data, authority data, industry research and analysis reports. We are committed to becoming a data and report sharing platform for professionals and decision makers. We look forward to working with you to record the development trends of today’s economy, technology, industrial chain and business model.Welcome to follow, comment and bookmark us, and hope to share the future with you, and look forward to your success with our help.

The following is the Enterprise Research Report of hotel industry in 2019 – Oyo From Dongxing Securities recommended by recordtrend.com. And this article belongs to the classification: Brokerage Report, Travel booking.

How sustainable is the Oyo model in China’s economy hotel market? We analyze Oyo from three angles of business model, operation mode and profit model, and discuss the development track and future trend of Oyo in China market by comparing Indian and Chinese markets.

Analysis of Oyo business model: light franchise model under capital support

Oyo: positioning the economic sunken blue ocean market, establishing the market scale and brand power rapidly with the light franchise mode and capital support. No matter in India or China, Oyo still takes the franchise mode, but it is different from the traditional way in that it is “low threshold” and “not fully standardized”.

At the same time, by cutting into the niche market of economy hotels – small and medium-sized single hotels, they skillfully avoid the Red Sea area with fierce economic competition (standard Economy Hotels with more than 80 guest rooms), and with the help of capital, they rapidly expand their scale and establish their own brand power.

Copying the Indian model, Oyo has become a phenomenal brand in China’s hotel industry

Enter the long tail market of economy type and below, fill the blank of hotel sinking. In recent years, in the context of the upgrading of consumption structure, the medium and high-end hotel market has become the focus of each giant. After more than ten years of development, the economy hotel has become a red sea. However, the long tail market where the economy hotel is located is still a blank market for chain hotel brands.

In a year and a half, 10000 stores went online, and Oyo created phenomenal expansion speed. In just one and a half years, Oyo hotel has become a phenomenal enterprise in the history of China’s hotel industry with its 10000 stores. It takes an average of 3.2 hours to sign up for a store, 227 new stores are added every month, 19 cities are settled every month, and the average renovation and online are 15 days, achieving the “Oyo speed”.

At present, it has settled in 320 cities in China, with more than 10000 hotels online and more than 500000 rooms. It plans to achieve the goal of 1500 + cities and 20000 + hotels in 2019. The company has announced that the owner renewal rate is as high as 97%, becoming the largest single brand hotel in China, the second largest hotel group in China and the sixth largest hotel group in the world.

1.7 billion US dollars of financing is in hand, and capital boosts the process of scale-up.

According to the latest news of the times of India in June 2019, Oyo is currently negotiating with investors (including existing investors such as Softbank and other new investors) on a new round of financing of US $1 billion. If this round of financing is successfully completed, the company valuation of Oyo is expected to reach US $10 billion.

According to incomplete statistics, since the establishment of Oyo hotel in 2013, if the financing in the latest negotiation is successfully completed, the company has accumulated at least 10 rounds of financing, with a total financing amount of more than 2.7 billion US dollars.

Among them, Softbank, a venture capital giant, has already held a little more than 46% of the shares of Oyo since it invested $1 billion in Oyo in September last year. Its phenomenal expansion has also attracted new investors to join in.

Because of its strong financial support, Oyo has been able to quickly integrate single hotels through the “zero franchise fee” way, and complete the task of “more than enough” for other domestic hotel groups.

China’s housing sector accounts for two-thirds of the global expansion

The satellite city of New Delhi was founded and India ranked first in seven years of development. In May 2013, the first Oyo Hotel officially opened with only 11 rooms. From the center of Huda, from Gurgaon (one of the satellite cities of the capital of New Delhi) to all India, from India to the world, after seven years of development, Oyo has rapidly grown into the largest economy hotel chain brand in India, with business covering more than 800 cities in 10 countries and regions around the world.

Oyo hotels are expanding rapidly worldwide, with two-thirds of the rooms in China. At present, Oyo operates 23000 hotels worldwide with 750000 guest rooms online. Among them, 10000 hotels and 500000 guest rooms in China constitute its most important business map.

From the perspective of the number of rooms, the company has become the sixth largest chain hotel brand in the world, and plans to add 1 million rooms in 2023, surpassing Marriott to become the world’s first Dalian chain hotel brand.

Comparison between China and India: after crazy expansion, do you choose to be a platform or a hotel?

India: frequent acquisitions, intending to build tourism ecological aggregation platform. Since 2018, the company has launched a global acquisition portfolio and successively acquired Indian companies in hotel, Internet of things, wedding planning and other fields.

In 2019, the company’s financing scale continues to expand, and the acquisition process also starts to speed up, successively acquiring local joint office start-up Innov8, Chinese accommodation brand “Qianyu” and Amsterdam B & B brand leisure.

When Oyo started business in India in 2015, it was blocked by makemytrip, the largest OTA in India. However, the counter-measures quickly changed into cooperation. The cooperation relationship in the initial stage and the main channel in the later stage enabled Oyo to get rid of the constraints of Ota on its growth path.

At present, the group’s territory involves accommodation, Ota, joint office, Internet of things, wedding banquet service and takeout platform, etc., and the intention to create a tourism ecological aggregation platform is obvious.

China: it is still a hotel inventory operator at this stage, and its long-term positioning is not clear.

Compared with the overall market layout at the group level, the development of Oyo in China is still in the stage of focusing on the scale expansion of its own hotels. Whether the future strategic positioning of Oyo is an online tourism aggregation platform or still a hotel inventory operator is still unknown. The way to build a tourism aggregation platform is both convenient and challenging.

Referring to the sales model in India, 70% of the existing hotel bookings come from the mobile terminal, 95% of which comes from the company’s own app. In this way, Oyo is not only a platform for generating demand, but also a supplier of hotel inventory. At present, Oyo is actively promoting its own apps and small programs in China, hoping to expand the reservation proportion of its own channels. We believe that mature self owned channels will overlap in the future Strengthening the big brand effect will provide convenience for the company to build an aggregation platform.

However, the domestic OTA market presents a situation of one superpower and many strengths, and the industry concentration is high. From the perspective of Gmv, Cr4 is as high as 70.8% in 2018, and each major platform has a high voice in the hotel industry chain. As a result, Oyo has to pay huge channel fees for OTA traffic support. The company may not be willing to compete with domestic OTA giants as an aggregation platform.

Analysis of Oyo operation mode

Oyo takes the franchise operation mode in the hotel supply side, and the size of its direct stores is small (only 50 in China).

The direct store adopts the mode of leasing operation, and the person in charge of Oyo hotel is directly assigned to manage the store. Franchise stores adopt the light franchise mode, that is, zero franchise fee to absorb the single hotel, retain the hotel’s own characteristics, save a large amount of hard decoration transformation costs, lay cloth and soft clothing uniformly, and help owners standardize operation and management.

Hotel sales are divided into online and offline channels. Online sales include customers booking through Oyo self operated channels or third-party platform companies such as OTA, while offline sales means customers directly enter the store for consumption.

Hotel supply side: from scale to digitalization, technological innovation improves efficiency

Oyo hotel is committed to building intelligent hotel management system. From four aspects of channel optimization, dynamic adjustment, diversified strategies and market monitoring, the company realizes fast, comprehensive and excellent active revenue management. Through continuous iteration, the company aims to gradually develop PMS system from a management tool to a platform marketing service system to meet further management needs.

After the owner joined Oyo, it only takes 15 days from the property negotiation to the online with the help of standard operation manual and information management system. In the process of operation, all transactions in the hotel, including registration, check-out, statistics of in room toiletries, etc., can be completed in the mobile terminal software, and statistics of more than 600 items including payment and quotation can be carried out.

India: take the management as the guidance, proposed the franchisee management new plan.

At present, Oyo has more than 9000 franchise partners in 259 cities of India, and its business focus has shifted from scale expansion to fine management. In order to manage the increasingly large scale franchisee network more effectively, Oyo has launched two industry first franchisee management schemes, namely open and CIB, since April 2019, covering payment agreement, financial support and technical assistance , hotel operation app, etc.

The open, Oyo partner engagement network consists of three parts, namely, six core commitments, upgraded operation app and online micro community of franchisees.

After open, Oyo cash in Bank (CIB) is a financial loan solution for franchisees launched by Oyo after open. The plan aims to provide fast, convenient and mortgage-free loans below market price for franchisees who need to upgrade hotel decoration. All franchisees in India are eligible to apply for participation in the program. With the help of CIB calculator containing AI technology, franchisees can quickly understand the amount, interest rate and arrival time of loans. The approval of loans will be completed within 48 hours.

China: scale oriented, zero franchise fee expansion.

At present, the primary concern of Oyo in China is still the speed of expansion, because only after the realization of scale, can the advantages brought by technology and management be shown, thus greatly reducing the hotel cost at the end of the supply chain.

The key for Oyo to attract small and medium-sized single hotels to join in in China lies in the following: 0 yuan franchise fee, even about 20000 yuan “decoration fee”, and providing staff training, system management and other services. Only 3% – 8% of the hotel’s later turnover is charged as commission Commission.

Oyo not only does not set a threshold for the number of rooms in the hotel, but also basically exempts all franchise fees. In addition, Oyo’s room renovation is mainly based on uniform cloth laying, so it saves a large amount of room renovation costs for the owners.

Although the major hotel groups tested the sinking market 3-5 years ago, the overall scale is limited. The emergence of Oyo has led the traditional giants to pay more attention to the sinking market. In Q1 of 2019, Huazhu raised the store opening guidelines, of which 300 were basically composed of “soft brands”.

The following table compares the joining policies of major domestic economy brand hotels and Oyo. The starting cost of standard economy brand of traditional leading hotel group is generally more than 3 million yuan, and the joining cost of sinking brand is between 600000-1200000 yuan. The 0 yuan franchise condition issued by Oyo is very attractive to franchisees.

Sales side: push genes down strongly to complete the transformation from offline to online

Whether in India or China, Oyo is committed to “micro market”. Compared with most traditional chain hotels, in order to avoid being constrained by OTA platform online, Oyo tends to expand offline traffic, which is called “micro market”, To this end, a huge ground push team has been set up to explore offline customers from small communities, communicate with travel agencies, translators, taxi drivers and bus operators, build offline drainage channels, and finally realize the transformation from offline traffic to online traffic.

India: the traffic comes from online, and the brand power in the fragmented market has been improved rapidly.

India’s local mobile subscribers currently account for more than 70% of the total subscription volume of Oyo, 95% of which comes from its own apps.

The high proportion of online traffic shows that the transformation of Oyo from offline traffic to online traffic is highly completed in China, and the audience’s recognition of the brand is constantly improving. The number of members of oyowizard (loyal customer program) has increased by 50% in the past two months, while the number of active users (customers who have settled in more than five times in six months) has increased by more than 400% in recent three years.

India’s local branding process is fast, thanks to the vacancy of its economic chain brands.

Before the rise of Oyo, Indian hotel industry was not systematic and highly fragmented. Before the emergence of brand economy hotel, consumers had to face uneven service and asymmetric price. Due to the limitation of self financing, the economy hotel market could not provide standard service experience on the basis of scale.

With the support of capital, Oyo integrates the domestic hotel industry with the light asset operation mode, and fills the vacancy of domestic economy hotel brand in India.

China: the flow comes from offline, and the promotion of brand power in mature market is slow.

Oyo once said that about 72% of users came from offline walk in, and the number of customers on online OTA platforms such as Ctrip and Feizhu accounted for less than 30%. Based on the grassroots survey data, we speculate that OTA channels account for 30% – 40%, offline channels account for 60% – 70%, and self owned app channels account for less than 1% of China’s order sources.

Compared with the contribution of 70% of online orders and 95% of its own app channels in India, the brand effect of Oyo in China is weak, and it can not affect the consumer behavior of users, thus completing the transformation of offline to online traffic.

The process of branding in China is slow. We believe that it is mainly affected by the mature domestic budget hotels and OTA market.

On the one hand, after a long period of development, the domestic economy hotel has a mature market pattern. Different from the vacancy of Indian economy hotel brand, the domestic 7-day, Hanting, Home Inns and other economy hotels have been deeply rooted in the hearts of the people after more than ten years of development, so it is difficult for novice Oyo to quickly stand out in the mature market;

On the other hand, the domestic OTA market penetration is high, and it enjoys a higher voice in the hotel industry chain. In the process of brand building, Oyo is bound to be subject to the domestic OTA giants. In contrast, the situation in India is quite different. Orders from India’s domestic OTA account for only 3% of the total.

Analysis of Oyo profit model

Increase the volume with low price and improve the comprehensive RevPAR

Oyo’s target hotels are mostly small and medium-sized or even micro single hotels, with low overall occupancy rate and average room price. Therefore, these hotels have higher economic benefits and potential for improvement of RevPAR after certain standardization and brand chain promotion.

Oyo helps franchisees improve RevPAR, and then draws commission from the turnover. Considering that there is no charge for Oyo hotels to join, only 3% – 8% of the hotel turnover is charged as commission. Therefore, increasing the revenue of the franchised hotels is the key to realize the profit and loss balance of Oyo.

According to the statistics of Oyo, the occupancy rate of the hotel will double after 90 days by adopting various optimization measures.

The optimization measures include door update, dynamic pricing management, PMS system optimization, and so on. The most direct and effective measure is to reduce the room price. After the price reduction, there is a significant price difference between the price reduction and the surrounding chain hotels. Through the price advantage, the passenger flow is attracted, and the RevPAR is improved accordingly.

Upgrade 2.0 mode to share risks and benefits with franchisees

Under the new mode, the owners enjoy the performance guarantee, the losses are compensated, and the profits are shared. On May 30, 2019, the company officially launched the Oyo Hotel 2.0 model at the Oyo hotel strategic upgrade conference.

From June 1, Oyo Hotel 2.0 mode will be launched nationwide. Under the new mode, the profit model of Oyo hotel will change from paying franchise fee and simple commission to sharing risks and profits between brand side and owners.

Oyo will guarantee the operating performance of the franchised hotel owners. If the performance target is not met, the headquarters will compensate for the gap. If the profit is made, both parties will share the profits. Oyo Hotel and the franchisee will jointly bear the risks caused by the fluctuation of business conditions and the changes of market situation.

From the average level, we assume that 20% of the hotels only achieve 80% of the performance target. At the 10% net interest rate of the hotel industry, the total revenue subsidy will account for 8% of the total revenue of Oyo (under the 5% commission level).

Revenue and cost split of Oyo China market

Judging from the scale data, Oyo has indeed created a store opening myth in China. However, the biggest problem that Oyo is facing now is how to make profits in the mode of low price competition. Here, we split the revenue and cost of Oyo in recent two years.

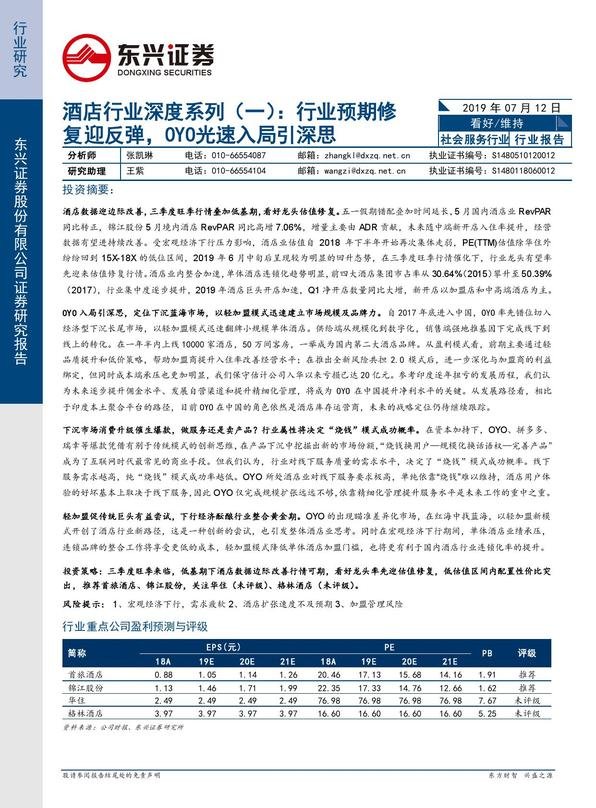

According to a conservative estimate, Oyo’s accumulated loss in China has exceeded 2 billion yuan. According to the table below, we roughly estimate that in the first year of Oyo’s entry into the Chinese market, its total revenue was about 80 million yuan, but after deducting store renovation costs and labor costs, the scale of loss was about 520 million yuan.

In 2019, the scale of operation of Oyo Hotel continues to expand, followed by higher renovation costs and labor costs. In addition, the subsidy action of “sharing risks and sharing benefits” started in June 2019, and the sky high channel fees paid by OTA, we estimate that the loss scale will reach about 1.6 billion yuan.

After financing US $1 billion in September 2018, Oyo plans to invest 600 million of it in the Chinese market. At present, it is conservatively estimated that more than half of this financing has been spent, mainly to OTA channel fees and labor costs, and the operating costs are expected to remain high after 19 years.

We believe that it will still take some time for Oyo to achieve the turnaround situation in the Indian market in China, and the company still needs to seek a new round of capital investment on the basis of cost reduction.

After 2019, in the short term, with the number of franchised hotels tending to be saturated, hotel renovation costs will be significantly reduced, and labor and other operating costs will be correspondingly reduced with the improvement of management efficiency. The overall cost will show a downward trend, but OTA channel fees still occupy a large proportion in the cost side.

In the long run, with reference to India’s development model of turning losses year by year, we believe that gradually improving the level of commission, developing self-employed channels and improving refined management will be the key to China’s Oyo to improve its net profit level.

Logic analysis of success of Blockbuster: Discussion on consumption upgrading in market segments and Internet “money burning” mode

With the birth of Oyo, we have some thoughts on the capital plus “burning money + exploding money” start-up companies in many industries in recent years. Pop up means phenomenon, flow and user realization. The success path of products in different industries is also different. Here, we focus on the consumption upgrading of market segments, and make a comparative analysis on the success logic of popular money in the industries of Oyo, pinduoduo and Ruixing.

Huazhu is attacking in many ways, benchmarking the emerging power of economy hotel

In the first quarter, the guideline for opening stores throughout the year was raised, and the hotel structure was continuously optimized

Huazhu has gradually improved its brand system through its own expansion and extension of merger and acquisition mode. After nearly 15 years of development, it now covers 18 brands, including economy, medium and high-end, with 4396 hotels and a total room number of nearly 440000.

The Q1 revenue of Huazhu will increase by 14% year on year in 2019, of which the revenue of medium and high-end hotels will increase by 30%, and the proportion of the total revenue will increase by 7 PCT. to 54%. The effect of medium and high-end layout will continue to show. In the first quarter, the company raised the annual opening guidelines of 300 to 1100-1200. At present, there are 1311 hotels to be opened, of which 86% are medium and high-end brands. The hotel structure is expected to continue to be optimized.

In the field of economy hotel, facing the new competitor Oyo, Huazhu has also developed corresponding measures at the group and company level.

Group level investment in H Hotel, a single hotel acquisition war

Huazhu invests in new economic chain brands and plans to open 20000 in four years. On May 30, 2019, H chain hotel jointly invested by Huazhu group and IDG capital officially appeared in Chengdu.

According to official statistics, since the establishment of the brand 100 days ago, H chain hotel has covered 80 cities in China, with more than 500 franchise hotels, more than 30000 rooms and more than 1 million guests. It is estimated that the number of franchised hotels will reach 3500 by the end of this year and more than 20000 by the end of 2022.

The profit model is similar to that of Oyo, and the entry threshold is relatively higher. H chain hotel adopts the profit model of free franchise fee and low commission after the event, but h chain hotel has set relatively strict franchise standards relative to Oyo, such as requiring that the monthly income of the franchise store is not less than 90000 yuan, the average room price is between 120 yuan and 400 yuan, and the hotel must have a fire prevention license.

After joining, it will upgrade and transform the soft decoration, facade, hotel operation system, personnel training, traffic, membership system and other aspects. H Hotel will also provide the franchisee with an average of 50000 yuan per store.

The hotel system is fully connected with Huazhu, and the single hotel is upgraded with algorithm technology. It is worth noting that H Hotel, as a hotel brand with the blood of Huazhu, requires franchisees to use the unified management system of Huazhu in terms of hotel operation management system.

PMS (room management system), CKS (central reservation system) and CRM (member management system) are required to be used to realize the information exchange of franchise hotels. Huazhu’s IT system has always represented the highest level of the industry. There is almost no marginal cost for Huazhu to increase the system terminal, but for H Hotel, the interconnection system will bring huge efficiency advantages.

Soft brand building, light assets into a new chain mode

International hotel group already has precedent, low threshold join more temptation. The so-called “soft brand” is not a new concept. The goal of establishing a soft brand is to integrate individual hotels in the market through the mode of light assets. The chain trend of single hotels in the world has lasted for many years. Almost all international hotel groups have launched soft brands, such as Marriott’s autograph collection, Accor’s MGallery, Hilton’s curio, etc.

Generally speaking, the joining fee of soft brand is 30% – 50% lower than that of hard brand, and the transformation cost is also lower, which is in line with the profit model of single hotel.

It is a long way to go to integrate single hotels and promote the construction of “soft brands” in all fields of multi brands. At the level of listed companies, in view of the radical situation of Oyo in China, Huazhu has also taken corresponding defensive measures, namely, speeding up the process of “soft brand” joining, and will expand 300-400 “soft brand” franchisees in this year, involving four brands: Haiyou, Yilai, Xingcheng and Meilun, corresponding to the economic, middle and high-end markets respectively.

At present, about 80% of the hotels in the Chinese market exist in the form of monomer. There is still a huge space for chain brands to explore and integrate in this part of the market. Compared with the traditional franchise mode, the cost of “soft brand” is lower, and the project quantity is small, and the integration process is relatively easy. Single hotels can share the central purchasing system, revenue management platform and online diversion channels after joining, which helps to reduce operating costs and improve operational efficiency.

If you want to get the full report, you can contact us by leaving us the comment. If you think the information here might be helpful to others, please actively share it. If you want others to see your attitude towards this report, please actively comment and discuss it. Please stay tuned to us, we will keep updating as much as possible to record future development trends.