A survey of China’s automobile aftermarket consumption in 2021

The following is the A survey of China’s automobile aftermarket consumption in 2021 recommended by recordtrend.com. And this article belongs to the classification: Automobile industry, Consumer research.

According to the results of the “2021 China automotive aftermarket consumption survey” (hereinafter referred to as the survey) conducted by China Automotive Finance Laboratory of 21st century economic report, 650 valid samples were collected from all over the country, covering all large and medium-sized cities from the first line to towns below the county level.

Since 2009, 21st century news has been focusing on “China’s automobile consumption trend”, and has successfully held 12 sessions of “China’s automobile consumption trend survey”. The purpose of this “China automobile aftermarket consumption survey” is to understand the consumption habits and trends of consumers in the automobile aftermarket, and provide decision-making reference for enterprises and industry practitioners. This survey involves four types of after market services: automobile maintenance, automobile boutique, automobile beauty and automobile modification.

The survey shows that 56.8% of the respondents choose to go to the channel outside the 4S store system for maintenance outside the warranty period, and the “loyalty” of the post-60s and luxury car owners to the channel is the highest; 64% of the respondents chose to buy car boutiques on the e-commerce platform, among which the post-80s and post-90s accounted for the highest proportion; 56% of the respondents spend less than 1000 yuan on car beauty every year; 11% of the respondents have done car modification projects.

The maintenance service is upgraded, and the channels outside the 4S store system shine brilliantly

In recent years, with the steady development of economy, China’s car ownership has formed a scale and increased year by year. The huge car ownership has laid a solid foundation for the vigorous development of the automotive aftermarket, and also provides a broad world for the aftermarket service (especially maintenance) channels outside the 4S stores.

According to the business model and the main service content, the current consumer routine maintenance channels can be roughly divided into: 4S stores that buy cars, other 4S stores of the brand, chain type brand repair & quick repair stores, parts brand chain repair shops, brand authorized repair factories and general repair & quick repair stores. Through the service innovation from different levels, all kinds of channels have found a long way to develop in the market.

The most important thing in the process of using a car is the repair and maintenance of the vehicle. For vehicles beyond the warranty period stipulated by the manufacturer, do you choose 4S stores or other third-party channels with their own advantages?

In the survey, we found that different car owners have different preferences. The preferences of the respondents inside and outside the warranty period are as follows: the proportion of 4S store channels decreased from 69.38% within the warranty period to 43.2% outside the warranty period; The proportion of channels outside the 4S store system increased from 30.62% within the warranty period to 56.8% outside the warranty period, with great development potential, especially the proportion of chain brands (such as tuhu yangche, qunjiechebao, mianshifu, cheqishi) and general maintenance & quick repair shops increased by 7.73% and 19.34% respectively.

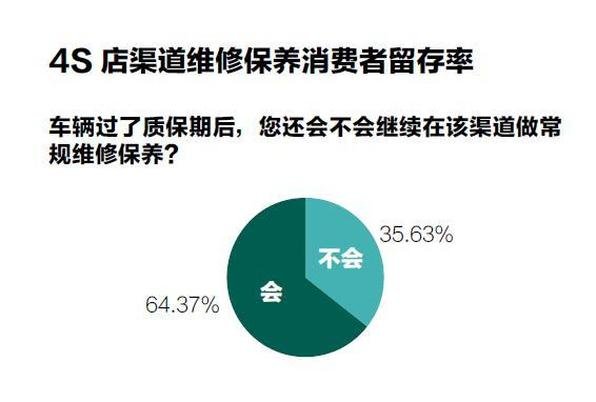

While 35.63% of the respondents who do maintenance in the 4S shop during the warranty period will leave the 4S shop after the warranty period and choose other channels.

At the same time, the survey conducted a systematic analysis of the routine maintenance channels from the city, vehicle price, vehicle type and other dimensions.

In different age groups, we found that the “post-60s” had the highest “loyalty” to the channel, 84.21% of the respondents said they would continue to do routine maintenance in the original channel, while the “post-80s” were relatively willing to try new channels in terms of personal preferences and consumption habits, and 31.06% of the respondents said they would not continue to do routine maintenance in the original channel.

The survey also showed that compared with other customers, luxury car owners with 500000 or more had the highest “loyalty” to the channel, and 78.57% of the respondents chose to continue to do routine maintenance in the original channel, mainly because of “original parts”, “standard process” and “hard technology”.

E-commerce is the main way to buy high-quality cars, while beauty and refitting are favored by luxury brand owners

In recent years, with the strong intervention of e-commerce platform in the automotive aftermarket service, automotive boutique has ushered in a more convenient and inexpensive purchase channel. According to the survey, 64% of the respondents choose to buy car boutiques on the e-commerce platform, among which the post-80s and post-90s account for the highest proportion. For the “old drivers” of the post-60s, the car service store is the most important purchase channel besides the e-commerce platform, accounting for 33.33%.

In terms of car beauty, the survey shows that the annual spending of respondents on car beauty projects is mainly less than 5000 yuan, of which less than 1000 yuan accounts for 56%, and 1000-5000 yuan (including 1000 yuan) accounts for 36%. With more and more car beauty projects, 7% of respondents spend 5000-10000 yuan (including 5000 yuan) every year.

In terms of car refitting, the survey shows that 11% of the respondents have done car refitting projects, of which 52% have spent less than 10000 yuan, and 28% have spent between 10000 yuan and 20000 yuan (including 10000 yuan). With the increasing number of refitting projects, 15% have spent between 20000 yuan and 50000 yuan (including 20000 yuan).

In addition, we also found that in terms of the cost of car boutique, beauty and refitting, the owners of 500000 or more luxury cars have no doubt shown a strong gap with other owners. Obviously, the more high-end and more luxurious models need to pay higher vehicle costs. This also means that the upgrading of China’s automobile consumption market will bring greater growth space for automobile aftermarket consumption.

More reading: China toy consumption survey: price and brand factors Ipsos: 2015 Chinese citizens outbound (city) tourism consumption survey Youxin Research Institute: 2017 Q3 Internet second hand car consumption survey China toy consumption survey: favorite toy types in 2014 County mobile shopping amount exceeded 200 billion yuan, rural has become a strategic e-commerce place PQ media: 2014 global consumer Foreign digital media consumption survey Fudan University: post-80s consumption survey shows that the higher the education level, the less willing to save money. Aurora big data: China’s auto aftermarket app research report predicts that the scale of China’s auto aftermarket will exceed 766 billion in 2015 Deloitte Consulting & Jingdong: China’s auto aftermarket logistics service insight report Yiguan: 2018 China’s auto aftermarket e-commerce annual comprehensive analysis (with download) Auto Aftermarket One of the 100 page series of reports: maintenance and repair, eliminating the false and preserving the true iResearch Consulting: white paper on online service of China’s automotive aftermarket in 2018 (with download) Aurora big data: Research Report on app of China’s automotive aftermarket in 2017 trustdata: inventory of China’s automotive aftermarket e-commerce industry in 2016 – chapter on maintenance e-commerce (with download)

If you want to get the full report, you can contact us by leaving us the comment. If you think the information here might be helpful to others, please actively share it. If you want others to see your attitude towards this report, please actively comment and discuss it. Please stay tuned to us, we will keep updating as much as possible to record future development trends.

RecordTrend.com is a website that focuses on future technologies, markets and user trends. We are responsible for collecting the latest research data, authority data, industry research and analysis reports. We are committed to becoming a data and report sharing platform for professionals and decision makers. We look forward to working with you to record the development trends of today’s economy, technology, industrial chain and business model.Welcome to follow, comment and bookmark us, and hope to share the future with you, and look forward to your success with our help.