New traffic and new consumption From Guoyuan securities

RecordTrend.com is a website that focuses on future technologies, markets and user trends. We are responsible for collecting the latest research data, authority data, industry research and analysis reports. We are committed to becoming a data and report sharing platform for professionals and decision makers. We look forward to working with you to record the development trends of today’s economy, technology, industrial chain and business model.Welcome to follow, comment and bookmark us, and hope to share the future with you, and look forward to your success with our help.

The following is the New traffic and new consumption From Guoyuan securitiesrecommended by recordtrend.com. And this article belongs to the classification: Brokerage Report, Webcast.

At the current time point, from traffic and platform to consumer brands are undergoing tremendous changes. We believe that e-commerce content and content e-commerce will become a long-term trend. At the same time, the traditional shelf-life e-commerce will be gradually cut off by the content e-commerce, in which the live e-commerce with high conversion rate ushers in the outbreak. At the same time, with the rise of decentralized e-commerce mode, more and more businesses pay attention to private domain traffic. We are optimistic about the development of private e-commerce in wechat ecology.

Under the new e-commerce and marketing mode, the bargaining power of “red man” as the core carrier of content continues to improve, KOL and MCN benefit. Compared with the traditional advertising realization, the profit ceiling of KOL / MCN is opened. On the consumer goods side, under the changes of new channels and marketing, a number of brands have risen rapidly in the short term, subverting the tradition. At present, they are mainly concentrated in food and beverage, beauty and personal care, small household appliances and other categories. In the future, they are expected to be copied into other consumer categories with higher upstream barriers, New brands are expected to continue to emerge, while traditional brands that embrace new changes are expected to increase market share in the process of reform.

The traffic dividend shrinks, and the single user value promotion becomes the key point. From the first year of mobile Internet in 2011, China’s mobile Internet has developed for nearly 10 years. According to QM data, in 2019, the number of mobile Internet active users in China will reach 1.135 billion, and the average user’s usage time will reach 6.2 hours. The flow pool will be saturated, the dividend will peak, and the inventory game will intensify. Improving the value of single user will become the focus of the new stage. Super APP WeChat, Alipay, QQ, hand wash, shake voice, etc., are used to layout panoramic ecology through small programs, and use their own tiktok advantages to empower ecological products or increase cash. Tiktok tiktok Kwai Kwai, a short video platform represented by the jitter and fast hand, has been rising rapidly since 2017. The number of active users has risen exponentially. At the end of 2019, the MAU of the quiver and the fast hand were over 500 million and 400 million respectively.

The competition for user time is intense, the use time of short video continues to increase significantly, and the duration of search, long video and social platforms decreases. Short video tiktok Kwai users grew rapidly, and the monthly usage time of the single voice users reached 19.22 hours at the end of 2019, and 15.09 hours for fast users. The usage time of social platform wechat, long video platform iqiyi, Tencent video and search platform Baidu will decline in 2019. According to QM’s statistics on the total monthly usage time of Internet segments in February 2020, the usage time of short video platforms has reached 16.1%, which is 4.5pct higher than that of the same period last year. The traffic continues to gather in more visible and fragmented short video platforms.

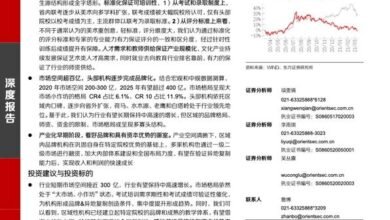

Advertising, as one of the most important platform realization modes, has been redistributed among various Internet platforms. The advertising revenue of search and vertical platforms has declined significantly. E-commerce, video and social platforms have maintained a growth trend, while short video platforms have shown outstanding performance.

In the Internet advertising in 2019, e-commerce platform advertising accounted for 35.9% of the total, ranking the first, with an increase of 3% compared with that in 2018. Although the share of search platform advertising still ranked second, its market share has dropped significantly from 21.0% in 2018 to 14.9%. The tiktok tiktok represented by the short video platform is rising rapidly, and the byphone beating of the parent company is expected to reach 100 billion in 2019, almost double the figure in the year to come. Baidu and Tencent will become the second largest Internet advertising platform.

Under the pressure of economic downturn, brands pay more attention to the production ratio, and the share of effect advertising continues to increase. Traditional advertising can be divided into two types: brand advertising and effect advertising. Brand advertising aims to establish product brand image and improve product market share, which has the characteristics of long time, slow penetration and cross media; effect advertising aims to achieve quantifiable effect, and advertisers only need to pay for measurable results, which has the characteristics of short time and fast effect. Under the downward pressure of economic growth, the brand side’s marketing budget has been tightened, and they are more inclined to put in advertising with significant short-term returns. According to questmobile’s data, the landing page of FMCG advertising investment from January to September 2019 will reach about 60% in the second half of the year.

What is the underlying logic of the outbreak of live e-commerce transactions? We think it mainly comes from the newly added + platform inclined flow and high conversion rate. On the other hand, the increase of live broadcast traffic / GML brought by the live broadcast traffic of the traditional e-commerce platform is 1. In the process of expanding the live broadcast e-commerce, the traditional platform allocates more stock resources, which jointly drives the rapid growth of live e-commerce traffic. (2) Conversion rate: much higher than traditional e-commerce. The traditional purchase conversion link is long, from cognition, grass planting to search and purchase, and the chain is long. Under the live e-commerce, the conversion link is very short, and the closed-loop from “planting grass” to “weeding” can be completed in a short time. It usually takes only a few minutes from the anchor’s explanation to the user’s order purchase. It is easy to form impulse purchase by superimposing the anchor’s script and “routine”. In terms of conversion rate, the purchase conversion rate of top online Red e-commerce can reach 20%, while that of social e-commerce is 6-10%, while that of traditional e-commerce is only 0.37%, which is far higher than that of traditional e-commerce.

If you want to get the full report, you can contact us by leaving us the comment. If you think the information here might be helpful to others, please actively share it. If you want others to see your attitude towards this report, please actively comment and discuss it. Please stay tuned to us, we will keep updating as much as possible to record future development trends.