Huawei plans to pay dividends of 61.4 billion yuan to shareholders, 130000 yuan and more than 460000 yuan per employee From Huawei

The following is the Huawei plans to pay dividends of 61.4 billion yuan to shareholders, 130000 yuan and more than 460000 yuan per employee From Huawei recommended by recordtrend.com. And this article belongs to the classification: Enterprise financial report.

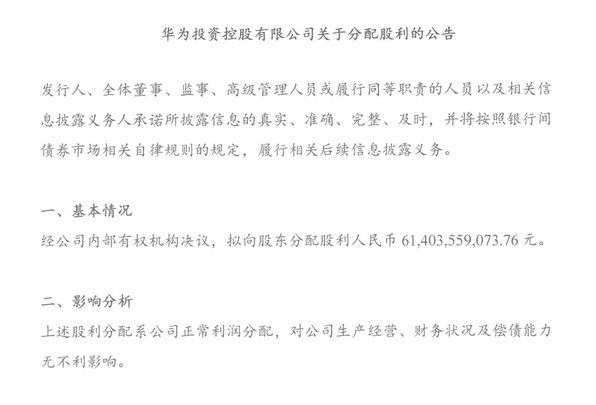

Recently, the announcement submitted by Huawei Investment Holding Co., Ltd. to Shanghai clearing house shows that it plans to distribute dividends of RMB 61403559073.76 to shareholders through the resolution of the competent authority within the company. Huawei is a private enterprise 100% owned by employees. The shareholder is Ren Zhengfei, the trade union committee of Huawei Investment Holding Co., Ltd. and the founder of the company. As of December 31, 2021, Ren Zhengfei’s total contribution is equivalent to about 0.84% of the company’s total share capital.

According to Huawei’s disclosure, the company implements the employee stock ownership plan through the labor union. The number of participants in the employee stock ownership plan is 131507 (as of December 31, 2021), and all participants are in-service employees or retirees of the company. According to this calculation, the average dividend of Huawei employees is about 467000 yuan / person.

On March 28, Huawei just released its annual performance for 2021. Affected by multiple factors, Huawei achieved a sales revenue of 636.8 billion yuan in 2021, a year-on-year decrease of 28.6%; However, the company’s net profit remained growing, with a net profit of 113.7 billion yuan during the period, a year-on-year increase of 75.9%.

Previously, Huawei confirmed that Huawei’s employee stock ownership dividend in 2021 is expected to be 1.58 yuan per share, down 15% from 1.86 yuan per share in 2020. According to the dividend of 1.58 yuan per share, Huawei’s current total share capital is about 38.8 billion shares.

Huawei’s share price has been stable at 7.85 yuan and its dividend of 1.58 yuan in the past three years, exceeding the dividend yield of 20% in proportion.

Huawei will give the dividend proportion according to the actual situation of the company every year. The highest dividend was in 2010, with a dividend of 2.98 yuan per share, and the lowest dividend was in 2017, with a dividend of 1.02 yuan per share.

Meng Wanzhou, CFO of Huawei, previously said at the performance conference that Huawei may have passed through the “black barrier” and will continue to increase investment in talent and R & D in the future. Meng Wanzhou set the tone for Huawei’s performance in 2021 as “financial stability and overall operating results in line with expectations”. “Our scale has become smaller, but our profitability and cash flow acquisition ability are increasing, and the company’s ability to deal with uncertainty is improving.”

More reading: Huawei financial report: Huawei’s sales revenue in Q1 2021 was 152.2 billion yuan, down 16.5% year-on-year. Huawei financial report: Huawei’s sales revenue in the first half of 2019 was 401.3 billion yuan, up 23.2% year-on-year. Huawei financial report: Huawei’s global revenue in 2019 was 858.8 billion yuan, up 19.1% year-on-year. In depth analysis of data, Huawei’s revenue in the first half of 2020 increased 13.1% Huawei: 1q21 revenue fell sharply to 150 billion yuan, and net profit soared 27% year-on-year. Huawei financial report: In 2011, Huawei’s total sales revenue reached 203.9 billion yuan, with a year – on – year increase of 11.7 percent and net profit of 11.6 billion yuan. Huawei financial report: Huawei’s revenue in 2015 was 60.8 billion US dollars, with a year – on – year increase of 37 percent. Huawei Investment Holding Co., Ltd. 2019 annual report Huawei financial report: Huawei’s revenue in 2013 was 239 billion yuan, with a year – on – year increase of 8.5 percent. Counterpoint: Huawei ranked third in the global smartphone shipment ranking in 2017 with a 10 percent share. Counterpoint: the global high – end smartphone market sales in 2021 were up to the same period last year Growth of 24% sigmaintell: Samsung / Huawei / Xiaomi and other manufacturers accelerated the layout, and the shipments of folding mobile phones increased by 172% in 2021. IFI: Apple ranked seventh in the list of the top 50 U.S. patent applications in 2021. Forbes: Huawei ranked first in the list of the world’s best employers in 2021. Huawei: the number of upgraded users of harmonyos 2 exceeded 100 million in September 2021

If you want to get the full report, you can contact us by leaving us the comment. If you think the information here might be helpful to others, please actively share it. If you want others to see your attitude towards this report, please actively comment and discuss it. Please stay tuned to us, we will keep updating as much as possible to record future development trends.

RecordTrend.com is a website that focuses on future technologies, markets and user trends. We are responsible for collecting the latest research data, authority data, industry research and analysis reports. We are committed to becoming a data and report sharing platform for professionals and decision makers. We look forward to working with you to record the development trends of today’s economy, technology, industrial chain and business model.Welcome to follow, comment and bookmark us, and hope to share the future with you, and look forward to your success with our help.