In the first quarter of 2022, China’s wearable device Market shipped 25.84 million units, a year-on-year decrease of 7.5% From IDC

The following is the In the first quarter of 2022, China’s wearable device Market shipped 25.84 million units, a year-on-year decrease of 7.5% From IDC recommended by recordtrend.com. And this article belongs to the classification: IDC, Intelligent hardware.

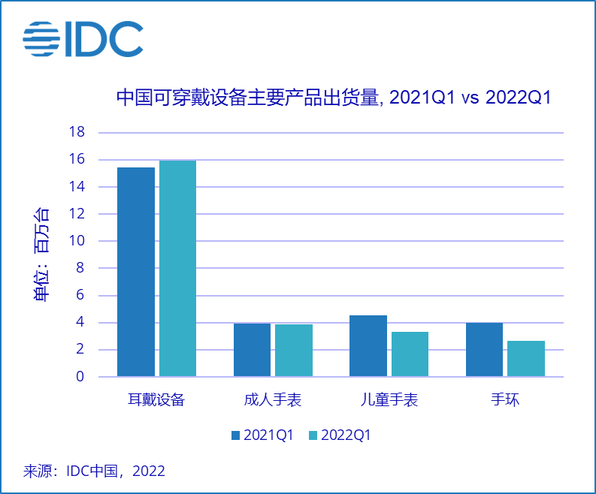

According to IDC’s quarterly tracking report on China’s wearable device market, in the first quarter of 2022, China’s wearable device Market shipped 25.84 million units in the first quarter of 2022, a year-on-year decrease of 7.5%.

In the first quarter of 2022, the ear wear equipment market shipped 15.96 million sets, a year-on-year increase of 3.5%. Among them, only the real wireless earphones maintained a year-on-year growth of 3.2%, but the market growth slowed down significantly due to the overdraft of demand in the promotion season at the end of last year, limited product function upgrading and the epidemic situation in some regions.

The watch market shipped 7.16 million sets in the first quarter of 2022, a year-on-year decrease of 15.3%. Among them, there were 3.86 million adult watches, a year-on-year decrease of 1.7%; The shipment of children’s watches was 3.3 million units, a year-on-year decrease of 27.2%. In this quarter, the watch market focused on optimizing channel inventory to prepare for the “618” promotion in this quarter. At the same time, the impact of the epidemic on outdoor activities and consumer sentiment caused a decline in shipments in the first quarter to a certain extent.

In the first quarter of 2022, the bracelet market shipped 2.63 million sets, a year-on-year decrease of 33.6%. The bracelet market has been affected by multiple factors such as product form competition, epidemic home and the upcoming launch of new products, and the continuous downward trend is obvious.

In the first quarter of 2022, the wearable market experienced a year-on-year decline, which was caused by repeated local epidemics, falling consumer sentiment and industry upgrading bottlenecks. China’s wearable market is currently facing growth challenges. In the short term, it can stimulate demand through price stimulation and fully tap existing demand through refined market positioning; In the long run, more functional upgrades and rich scenarios are needed to drive the emergence of new consumer demand.

Price strategy flexibility

In the adult watch market, various manufacturers have increased their promotional efforts during the 618 period this year, which has stimulated and stimulated the market demand and shipment scale to a certain extent. With the passage of product sales time and the launch of new products, the watch market may usher in more price adjustments in the second half of the year, which will become an important driving factor for shipment growth in the short term.

Market positioning refinement

Under the current development level of software and hardware solutions, it is more important to further subdivide the target population and fine market positioning. It will be increasingly difficult to leverage large-scale market demand only by using the strategy of single product explosion. Refined market positioning includes target population, application scenarios and price segments. Differentiate fashion, business, sports, outdoor and other elements in terms of design and function, cooperate with the distribution of different price segments and brand tonality, or transform more potential users.

Diversity of functions and scenarios

On the basis of current sports function, health monitoring related functions have been gradually improved in the technical reserves of most head manufacturers. In addition, wearable devices still have a wider range of application scenarios to be explored: for example, multimodal interactive applications with VR and other devices in game entertainment scenes, and driver status monitoring in vehicle scenes. IDC related research shows that the driver health / driving status monitoring in intelligent connected vehicles has attracted more attention and attention from users, and is used more frequently among users who have already used it.

Panxuefei, senior research manager of IDC China, believes that the growth process of the wearable market is not a smooth linear development, but a phased growth in exploration. After the single product detonated the market for many times, the growth rate slowed down, and then bred the explosive products waiting for the next successful exploration. In the past three years, sports watches, real wireless earphones and active noise reduction earphones have exploded in the market, creating a period of rapid growth in the wearable market. Next, on the one hand, the market needs to prolong the periodic growth cycle as much as possible through fine positioning, on the other hand, it should continue to explore the growth points of the next stage. More reading: IDC: in Q3 2018, China’s wearable device Market shipped 14.5 million units, a year-on-year increase of 12.5% IDC: in the third quarter of 2021, China’s wearable device Market shipped 35.28 million units, a year-on-year increase of 5.0% IDC: in the second quarter of 2020, China’s wearable device Market shipped 26.58 million units, a year-on-year increase of 4.1% IDC: in Q1 2016, China’s wearable device Market shipped 8.464 million units, a month-on-year increase of 5.7% IDC: in the third quarter of 2020, China’s wearable device Market The wearable device Market shipped 32.93 million units, with a year-on-year increase of 15.3%idc:313million global smartphones shipped in the second quarter of 2021, with a year-on-year increase of 13.2%idc:78.98 million units of China’s wearable device Market shipped in 2021, with a year-on-year increase of 55.4%idc:top ten forecasts of China’s PC market in 2019 idc:q1 European wearable device Apple’s market share reached 35.6%idc: it is expected that the wearable device shipment will increase by 60million IDC: it is expected that the global wearable device market will increase by 60million in 2020 IDC Wearable device shipments reached 400million IDC: in Q3 2019, China’s wearable device shipments reached 27.15 million units, a year-on-year increase of 45.2% IDC: in the second quarter of 2021, China’s wearable device Market shipments reached 36.14 million units, a year-on-year increase of 33.7% IDC: in 2019, China’s enterprise level external storage market reached $4.01 billion, a year-on-year increase of 16.8% IDC: in 2019, China’s smart speaker Market shipments reached 45.89 million units, a year-on-year increase of 109.7%

If you want to get the full report, you can contact us by leaving us the comment. If you think the information here might be helpful to others, please actively share it. If you want others to see your attitude towards this report, please actively comment and discuss it. Please stay tuned to us, we will keep updating as much as possible to record future development trends.

RecordTrend.com is a website that focuses on future technologies, markets and user trends. We are responsible for collecting the latest research data, authority data, industry research and analysis reports. We are committed to becoming a data and report sharing platform for professionals and decision makers. We look forward to working with you to record the development trends of today’s economy, technology, industrial chain and business model.Welcome to follow, comment and bookmark us, and hope to share the future with you, and look forward to your success with our help.