In the third quarter of 2021, China’s wearable device Market shipped 35.28 million units, with a year-on-year increase of 5.0% From IDC

The following is the In the third quarter of 2021, China’s wearable device Market shipped 35.28 million units, with a year-on-year increase of 5.0% From IDC recommended by recordtrend.com. And this article belongs to the classification: IDC, Intelligent hardware.

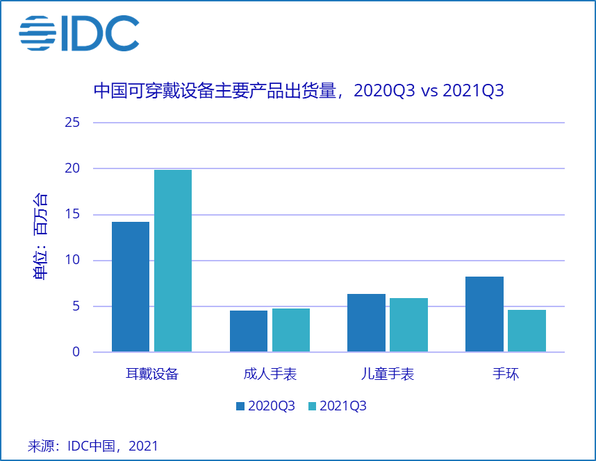

According to IDC’s quarterly tracking report on China’s wearable device market, in the third quarter of 2021, the shipment of China’s wearable device market in the third quarter of 2021 was 35.28 million units, a year-on-year increase of 5.0%. The market growth rate decreased significantly, mainly due to weak market demand, unclear product positioning and some supply pressure.

Among them, the market shipment of EARWEAR equipment was 19.9 million units, with a year-on-year increase of 40.0%. The market is driven by low price segment products and still maintains a rapid growth rate. With the key layout of more mobile phone manufacturers, the growth of real wireless market will be particularly significant.

The shipment volume of watch market was 10.68 million, a year-on-year decrease of 2.3%. Among them, 4.75 million adult watches were shipped, a year-on-year increase of 4.7%; The watch market urgently needs the full participation of more manufacturers, which puts forward higher requirements for the positioning ability of manufacturers in functional scenarios and prices. 5.93 million children’s watches were shipped, a year-on-year decrease of 7.2%; Product homogenization and function upgrading are limited, the pull on market demand is greatly reduced, and the future growth of manufacturers will rely more on channel depth and radiation.

The shipment volume of Bracelet market was 4.61 million, a year-on-year decrease of 44.2%. Bracelet products generally usher in screen size upgrade and price rise, but the upgrade of functional scenarios is limited, which affects the market demand of bracelets to a certain extent; At the same time, some watch products positioned in the low-end market have a certain competitive impact on the bracelet.

IDC believes that the market competition between watches and bracelets in the field of low-cost large screen will continue until 2022. Although the demand for bracelets has been affected to some extent, the market upgrade will improve the functions and scenarios of bracelets, leaving differentiated needs to be met. The user base of bracelets also lays a certain foundation for the transition to the watch market. Manufacturers still have many opportunities in the field of low-cost wristbands.

1. The screen size of the head Bracelet manufacturer’s products will be upgraded and the price will rise, or the price range of 100 yuan will be sold for new manufacturers to enter

With the product screen upgrade and price rise of head Bracelet manufacturers, the 100 yuan price segment market will be gradually vacated. Due to the high price sensitivity of Bracelet users, the price segment of the market is still competitive. New manufacturers may cut in from the market price segment by virtue of their own mobile phone products or Internet content services.

2. In addition to the screen size upgrade, the bracelet products urgently need to be upgraded with new functions to improve the cost performance of the products

At present, the price of Bracelet products is generally rising. In addition to the upgrade of screen size, there are fewer iterations in function, which makes the cost performance of Bracelet products after the price rise different from the past, and also inhibits the demand for new addition and replacement to a certain extent. There are similar problems in the watch market in the low price segment, but due to the emerging rise of the market, the appearance of watch products and the dimensionality reduction offensive in marketing, the problem of insufficient cost performance is not as prominent as the bracelet market. Therefore, if low-cost large screen products want to further boost the market space, they need to continue to invest in the expansion of new functions and market education. The expansion of new functions can be the decentralization of more mature technologies in watch products or innovative applications in Bracelet products, including the improvement of IOT scenes, the monitoring of more health indicators and the carrying of other sensing technologies such as somatosensory control.

3. Enhance the stickiness of Bracelet users and make full use of the transformation from Bracelet users to watch users

Based on the high coincidence between bracelet and watch manufacturers, improve the stickiness of Bracelet users, fully develop Bracelet users and become potential users of watch products in the future. For manufacturers who have worked hard in the bracelet market for a long time, sitting on a large number of Bracelet users provides a pool of potential users of watch products. Improving the bracelet product experience will help to accelerate the development of watch product line. For manufacturers newly entering the bracelet market, bracelet products are important products to reach low demand and low budget users in the market at this stage. Strengthening the stickiness of Bracelet users from the initial stage will lay a good foundation for the brand reputation and recommended value of the wristband market.

Pan Xuefei, senior research manager of IDC China, believes that with the improvement of national living standards and the impact of the epidemic, sports health scenes have gradually attracted more attention, and wrist wear products are an important link in sports health scenes. With the rich participation of products and manufacturers, the market will be further subdivided in terms of function, price and target users in the future, and the wrist wear market in the medium and low price segment will face a wider audience and contain huge market space.

More reading: IDC: in Q3 of 2018, China’s wearable device Market shipped 14.5 million units, with a year-on-year increase of 12.5% IDC: in the second quarter of 2020, China’s wearable device Market shipped 26.58 million units, with a year-on-year increase of 4.1% IDC: in Q1 of 2016, China’s wearable device market shipped 8.464 million units, with a month-on-month increase of 5.7% IDC: in the third quarter of 2020, China’s wearable device Market shipped 32.93 million units Year on year growth of 15.3% IDC: in the second quarter of 2021, the global smartphone shipment reached 313 million units, an increase of 13.2% IDC: in 2020, the global VR / AR market will reach US $162 billion, with a compound annual growth rate of 181.3% IDC: in 2019, the shipment of China’s smart speaker market reached 45.89 million units, a year-on-year increase of 109.7% IDC: in 2019, the shipment of China’s smart speaker market reached 45.89 million units, a year-on-year increase of 109.7% IDC: in 2021 In the second quarter, China’s wearable device Market shipped 36.14 million units, a year-on-year increase of 33.7% IDC: in Q2 2020, China’s wearable device Market shipped 26.58 million units, a year-on-year increase of 4.1% IDC: in Q1 2019, China’s x86 server market shipped 662504 units, a year-on-year decrease of 0.7% IDC: in Q2 2019, China’s wearable device Market shipped 23.07 million units, a year-on-year increase of 34.3% IDC: 2020 global intelligent terminal Trend forecast IDC: the global wearable scale is expected to exceed 300 million in 2023 IDC: the global smart wearable market shipment is expected to reach 302 million in 2023

If you want to get the full report, you can contact us by leaving us the comment. If you think the information here might be helpful to others, please actively share it. If you want others to see your attitude towards this report, please actively comment and discuss it. Please stay tuned to us, we will keep updating as much as possible to record future development trends.

RecordTrend.com is a website that focuses on future technologies, markets and user trends. We are responsible for collecting the latest research data, authority data, industry research and analysis reports. We are committed to becoming a data and report sharing platform for professionals and decision makers. We look forward to working with you to record the development trends of today’s economy, technology, industrial chain and business model.Welcome to follow, comment and bookmark us, and hope to share the future with you, and look forward to your success with our help.