Central China Index in November 2021 From Puyi standard

The following is the Central China Index in November 2021 From Puyi standard recommended by recordtrend.com. And this article belongs to the classification: Investment & Economy.

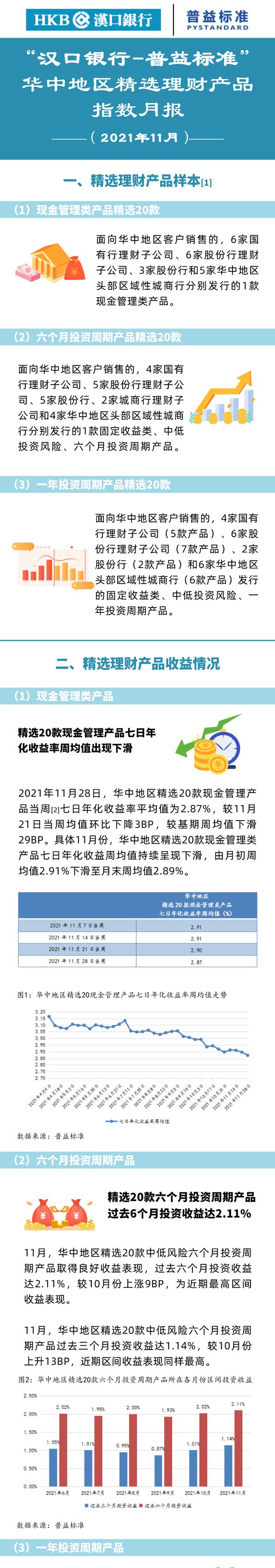

On November 28, 2021, the average annualized rate of return of 20 selected cash management products in Central China on the seventh day of the week [1] was 2.87%, which was 3bp lower than the weekly average on November 21 and 29BP lower than the weekly average in the base period. Specifically, in November, the weekly average value of 7-day annualized earnings of 20 selected cash management products in Central China continued to decline, from 2.91% at the beginning of the month to 2.89% at the end of the month.

In November, central China selected 20 low-risk six-month investment cycle products and achieved good income performance. The investment income in the past six months reached 2.11%, an increase of 9bp compared with October, which is the highest range income performance in the near future.

In November, 20 low-risk six-month investment cycle products were selected in Central China. The investment income in the past three months reached 1.14%, an increase of 13bp compared with October, and the recent interval income performance was also the highest.

More reading: Puyi standard: in February 2020, a total of 53 trust companies established 1213 collective trust products, raising a total of 94.675 billion yuan. Puyi standard: China’s banking wealth management market index in June 2020. Puyi standard: the systematic risk of the banking wealth management product market continued to decline in the fourth quarter of 2019. NBD & Puyi standard: 2018 China wealth management market report (attached) Puyi standard: full analysis of Bank net worth financial products in 2019 Puyi standard: China’s banking financial market index in March 2020 Puyi standard: China’s banking financial market index in November 2019 energypolicytracker: G20 countries committed to invest US $576.82 billion to support energy development CrunchBase: Chinese start-ups have invested US $93.8 billion in Musk’s 39 page Mars plan in 2018 And SpaceX 30 page prospectus KPMG: mid-2019 IPO and other capital market development trend report (with download) Orient Securities: Investment map of China’s semiconductor industry Li Feng: why does China have to build new infrastructure? By 2030, you will understand China Unicorn report: 2019 Tencent: 1q20 total revenue of 108.065 billion yuan, a year-on-year increase of 26%

If you want to get the full report, you can contact us by leaving us the comment. If you think the information here might be helpful to others, please actively share it. If you want others to see your attitude towards this report, please actively comment and discuss it. Please stay tuned to us, we will keep updating as much as possible to record future development trends.

RecordTrend.com is a website that focuses on future technologies, markets and user trends. We are responsible for collecting the latest research data, authority data, industry research and analysis reports. We are committed to becoming a data and report sharing platform for professionals and decision makers. We look forward to working with you to record the development trends of today’s economy, technology, industrial chain and business model.Welcome to follow, comment and bookmark us, and hope to share the future with you, and look forward to your success with our help.