2019 massive white paper on engine and household appliance industry From Huge calculation

RecordTrend.com is a website that focuses on future technologies, markets and user trends. We are responsible for collecting the latest research data, authority data, industry research and analysis reports. We are committed to becoming a data and report sharing platform for professionals and decision makers. We look forward to working with you to record the development trends of today’s economy, technology, industrial chain and business model.Welcome to follow, comment and bookmark us, and hope to share the future with you, and look forward to your success with our help.

The following is the 2019 massive white paper on engine and household appliance industry From Huge calculation recommended by recordtrend.com. And this article belongs to the classification: Home appliance industry, research report.

The market scale is shrinking, and the retail sales of many categories are declining. The smart home, which is known as the “star of tomorrow”, has not been able to open up the situation only with the hard support of emerging categories All kinds of status quo are showing that the home appliance industry is carrying a heavy load, as if you can reach for the top.

When we look at the home appliance industry without pessimism, we find that there are still opportunities: global market differences, the rise of intergenerational economy, the change of technology application scenarios after 5g and various brand playing methods are all contributing to the development of the industry and igniting all kinds of possibilities in the future. In the home appliance information industry, its development is not stagnant, it is more like the mutual speculation between industry and industry users The industry is constantly exploring the needs of users, and users are constantly trying the answers given by the industry.

This time, the home appliance industry has experienced the pain of transformation, and it is not impossible to expect to break the dome.

The industry remains resilient under heavy pressure

1. The imbalance between income and income growth leads to polarization of household appliances consumption

In 2016, the growth rate of domestic GDP slowed down to 6.8%, and economic growth entered the “six times”. The change of economic environment has also brought about changes in residents’ disposable income. From the data, low and middle-income households are greatly affected. The increase of disposable income continues to decline, while the average annual disposable income of middle and high income households keeps a relatively stable growth. With the development of income polarization, the consumption of household appliances will also present a polarization distribution.

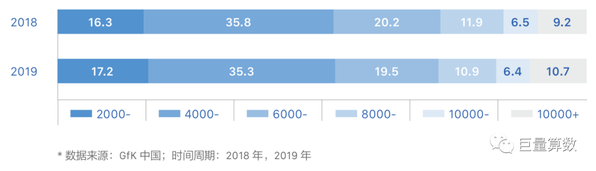

Taking refrigerators as an example, in 2019, the retail sales of the overall refrigerator market decreased by 0.9% year-on-year, with the highest decline of 6000-8000 yuan products in the medium price range, with a year-on-year decrease of more than 9%; while the low-cost and high-price bipolar markets showed a year-on-year growth of over 5% in the retail sales of markets below 2000 yuan, and over 16% in markets above 10000 yuan.

2. The entry-level market is driven by the development of the electric wire market

The development of E-commerce makes the market share of home appliances online continue to expand. However, according to the sales monitoring data of GfK in China, the development of household electric wire Shanghua has slowed down in recent years. Taking refrigerators as an example, the proportion of online retail sales of refrigerators in 2019 was 33.6%, which was only 2.3% higher than that in 2018.

From the distribution of refrigerator sales channels in different price segments, the degree of online is quite different. Among them, more than 66% of the online retail sales of products with less than 2000 yuan accounted for more than 40% of the online retail sales of products with 2000-4000 yuan. With the increase of product price, the proportion of online products is gradually reduced.

From the change of online share in two years, the online share of entry-level products below 4000 yuan has increased significantly, while the online share of medium and high-end products has shown a downward trend. It can be seen that the online market mainly grabs the entry-level market.

3. New consumption and upgrading

With the continuous improvement of people’s health awareness and the continuous pursuit of quality life, more and more new categories come into people’s lives. At first, the products such as tooth punch and laser hair remover, which were widely used in European and American families, were introduced into China and were supported and sought after by the majority of consumers. However, the use of these new categories has been regarded as a kind of “fashion and fashion”.

According to the retail monitoring data of GfK China’s tooth punch products, the sales volume of dental punch in 2019 increased by 58% year-on-year. Although the growth rate slowed down, it was still far higher than that of other oral care products. With the influx of domestic manufacturers, tooth punch has been rapidly popularized, and the purchase threshold has also been reduced.

4. More opportunities are brewing in the low-level market

In 2019, the retail sales of refrigerators and laundry showed a downward trend on a year-on-year basis. Among them, the first and second tier cities have relatively high market contraction due to the early popularization and other reasons.

From the perspective of different price segments, the entry-level market below 3000 yuan has the largest contraction, while the high-end market with more than 10000 yuan has increased in different levels of cities. In the refrigerator and laundry products, the demand for product upgrading is obvious. Due to the earlier upgrading in the first and second tier cities, the growth of high-end market shows a sluggish state, and the low-level market has more room for growth. The exploration of medium and high-end products to the low-level market has achieved good results.

In addition, the scene expansion of health demand, home beauty, and the rise of children’s economy also provide new growth points for the industry.

Marketing position of rapid development

More possibilities for industry recovery

1. Home appliance industry has a stable and strong demand for information

In today’s headlines, the home appliance information industry has entered the mature stage of the platform after experiencing the rapid growth in 2017-2018. Although the number of articles in 2019 is not doubled as before, it still has a growth rate of nearly 60%. In the case of rapid growth in the number of articles, the proportion of effective reading has increased steadily in the past two years. On the one hand, it shows that the quality of articles in the household appliance industry is constantly improving. On the other hand, it also shows that the demand side of the home appliance industry in today’s headlines is not saturated, and there is still much room for development.

In 2019, the single reading time of household appliances articles will exceed 85 seconds, that is, users will spend nearly one and a half minutes to read home appliances related information. With the fragmentation of entertainment and the high-speed pace of life, this digital profile affirms the quality and immersion of articles in the home appliance industry.

Unlike the tiktok household appliances information steady growth, users’ demand for home appliances is even more intense. In 2019, the video industry of the household appliances industry in the jitter increased by nearly two times compared with last year. Under the rapid growth of the tiktok supply, demand side data became more prominent, and the number of home appliances video playback in 2019 was more than three times that of last year.

The development of household appliances industry in the jitter is tiktok. In the past two years, more than 50% of the video playback per item increased, which reflects the user’s recognition of the video quality of home appliances. At the same time, the growth of nearly 30% of the average comments and likes shows that the video content of home appliances can well attract users’ interaction.

2. Talent effect helps the industry to be small and broad

Unlike today’s headlines, the UGC has the strong tiktok attribute. In this platform that users can create, the value of PGC’s dissemination is more prominent. Tiktok played a 42 role in the spread of brand content in the master’s voice. The tiktok master tiktok video accounts for only 1.6% of the video in the master video industry, but it brings 54.5% of the video playback. In addition, nearly 45 times the total amount of video is higher than that of the whole video, and the comments are nearly 32 times the same. With its professionalism, wanfanda people produce high-quality content, and spread rapidly and expand its influence through the fan effect.

3. Insight into users, know what they are good to go into the hearts of users

Everyone power has entered the state of competition in the stock market, while the competition in the field of small household appliances is becoming increasingly fierce. By continuously using new products and new technologies to attract the attention of users, all kinds of signs indicate that users have occupied a dominant position in the industry market. At this time, it is particularly important to speculate on users’ preferences.

From different types of home appliances, the interests of users are more beautiful, food has become the most preferred content of users, and health is also ranked in the top 5 of all kinds of home appliances interests. In addition, users of small household appliances and kitchen appliances have obvious preference for entertainment, and users of household appliances and kitchen appliances have obvious preference for agriculture, rural areas and farmers. In the face of users with diverse interests, access to industry information has become an indispensable part of users’ mental education. In addition to considering users’ interest preference, the coincidence degree of interested users also directly affects the effect of breaking circle. From the data point of view, different types of home appliances users with food and health interests have a high degree of coincidence.

Knowing what users like often brings twice the result with half the effort. In the top 200 videos, most of the videos are simple sharing and introduction of home appliances, among which good things sharing is the most popular video type, followed by the maintenance knowledge related to home appliances. As the general direction of the industry, smart home focuses on the integration of experience and life scenes. At present, there are relatively few such videos, which can be used as the follow-up direction.

The pattern of information market has changed

New marketing opportunities are embedded in it

1. Small household appliances show vitality and increase attention, leading the industry

With the continuous mention of users’ living standards, the pursuit of quality of life is becoming increasingly obvious. With the advantages of low technical barriers and high iteration speed, small household appliances can quickly fill the users’ needs, which has brought about the rapid development of this field.

Tiktok and tiktok household appliances consumption increase can see that most of the small household appliances are in the industry’s head position, whether the increase of the volume of the video or the increase of the Chinese article in the headlines. Among them, individual health care has become the dominant category of growth, and the growth rate of information consumption ranks first. Tiktok tiktok is a small kitchen, and the amount of video played by the players has increased greatly. However, the headline readings have been decreasing. The development of category depends heavily on the welfare of the whole household.

2. Cross border brands impact on the industry competition pattern

Cross border brands have a huge impact on the competition pattern of household appliances industry, and occupy an important position in the list. This kind of brand, represented by Xiaomi, has made some achievements in the original field and then moved to the home appliance industry. Relying on the accumulation and marketing experience in the original field, it quickly established its foothold in the home appliance market. Among them, Xiaomi not only became the household appliance brand with the highest attention in 2019, but also ranked first in the kitchen small electricity and TV categories. In addition, Xiaomi was also found in other popular brands.

Nearly half of the top brands on the list are deep-rooted brands of category, and the attention of such brands in a certain category accounts for more than 80% of the total attention of the brand, such as the voice volume, glory and Huawei voice in the TV field of Gree and oxks. Whether the category of deep-rooted brands or multi category coverage brands, the main source of voice mainly comes from large appliances, so we can see that everyone Electric has become the “foundation of life” of each brand.

3. Rapid rise of domestic brands focus on TV and personal health

Although the home appliance industry is moving forward with heavy load, the rise of domestic appliance brands has become an indisputable fact in recent years. The rise of domestic brands is not only reflected in technology accumulation and brand building, but also in sales market and information.

The attention of domestic brands has accounted for 87% of the top 200 brands, an increase of nearly 7% compared with that in 2018. From the data of attention growth, domestic brands are significantly ahead of foreign brands by 254% attention growth, while the number of domestic brands has decreased slightly in the past two years, which shows that their efficiency is improving.

In terms of the proportion of attention by category, the proportion of domestic brand attention of air conditioning, TV and kitchen small electricity is absolutely in the leading position, reaching more than 90%. Compared with 2018, the proportion of domestic brand attention of kitchen appliances shrank, especially the proportion of large kitchen electricity decreased by 22%. On the other hand, the proportion of TV and personal health care has increased by more than 10%. In terms of the proportion of brands, the number of domestic brands in kitchen appliances and TV categories has decreased. The rapid development of smart TV and smart screen in China provides a powerful driving force for category improvement.

4. Technology precipitates into a device to seize customers’ hearts

In recent years, smart home has been a hot topic in the home appliance industry. With the development of the Internet of things and the accelerated popularization of 5g network, the popularity of smart home is gradually rising. Although smart TV, smart speaker and other single category of smart home appliances have been accepted by consumers, due to the replacement cost, the uneven degree of intelligence among categories, and the low degree of standardization among brands, there is still a lack of successful cases in the market. Despite the difficulties, smart home is still the main direction of the industry development.

We counted the articles related to smart home, and aggregated the reading amount of articles according to the brand words of household appliances. Based on this, we produced the ranking of smart home related brands, that is, which brands are most often mentioned when referring to smart home. Judging from the current ranking, the brands on the list are mainly divided into two categories: industry rookies represented by Xiaomi and traditional strength groups represented by Midea and Gree. However, the brands on the list all have one common feature, which has strong brand power and technical precipitation.

When the industry bears weight, it is often the beginning of the break, but the opportunity is often fleeting. Knowing the current situation of the industry, finding out the future opportunities and opening up a new marketing area can find the way to break the dome under the dome.

More reading: China China’s tiktok era: April 2019 China’s household appliance market operation engine: 2019 first half year challenge research on white noise challenge (white download) huge engine: 2019 China automobile consumption trend report (download) huge engine: 2019 entertainment calculation white paper (download) huge engine: 2019 E-up effect marketing case manual (attached download) zhongyikang era: operation of China’s home appliance market in May 2020, China’s total retail sales of household appliances will reach 429.7 billion yuan in the first half of 2019 The growth rate of W24 scale of all kinds of household appliances in the market has been improved compared with last week, 618 has been greatly promoted and gradually entered a better situation. Easy to see: 2016 China virtual reality industry white paper (attached download) medical trend: 2019 Chinese cardiovascular industry white paper 1.0 (attached download) iResearch: 2017 Chinese adult online foreign language education industry white paper (download) meituan review Institute: 2018 oral industry white paper( Download attached)

If you want to get the full report, you can contact us by leaving us the comment. If you think the information here might be helpful to others, please actively share it. If you want others to see your attitude towards this report, please actively comment and discuss it. Please stay tuned to us, we will keep updating as much as possible to record future development trends.