It is expected that the price decline of Q3 nandflash will expand to 8-13% in 2022 From TrendForce

The following is the It is expected that the price decline of Q3 nandflash will expand to 8-13% in 2022 From TrendForce recommended by recordtrend.com. And this article belongs to the classification: PC, Intelligent hardware, Hardware equipment industry.

According to trendforce Jibang consulting, as demand has not improved, NAND flash output and process conversion continue, and the market oversupply intensifies in the second half of the year. It has become a market consensus that consumer electronics, including laptops, TVs and smartphones, are not booming in the peak season in the second half of the year, and the continuous rise of material inventory levels has become a supply chain risk.

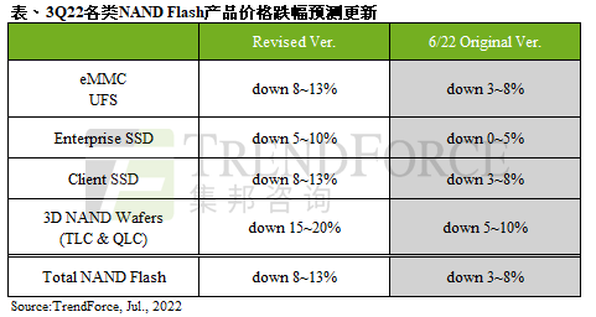

Due to the slow de stocking of the channel and the conservative attitude of customers, inventory problems overflow to the upstream supply side, and the seller is under increasing pressure to sell goods. Trendforce Jibang consulting estimated that due to the rapid deterioration of supply-demand imbalance, the price decline of NAND flash in the third quarter will expand to 8-13%, and the decline is likely to continue into the fourth quarter.

In terms of client SSD, due to the weak demand in the consumer market, PC brand customers have significantly lowered orders in the third quarter in order to absorb SSD inventory in the first half of the year. With the supplier’s focus on client SSD supply shifting to the 176 layer, even the 176 layer QLC SSD also began to ship. In addition, ymtc (Changjiang storage) will expand the shipment of laptop client SSD in the second half of the year, and the price competition is becoming increasingly fierce. The original factory has to expand the bargaining space to attract customers to increase the number of orders. Therefore, it is expected that the decline of client SSD in the third quarter will expand to 8-13%.

In terms of enterprise SSD, the purchasing momentum in the second half of the year will be lower than that in the first half of the year. The main reason is that the overall economic recession has affected the shipment of complete machines from server brand manufacturers, and the demand for enterprise orders has continued to decline, synchronously impacting the purchasing momentum of enterprise SSD in the third quarter; Secondly, the orders of cloud service providers in China were weak in the third quarter, and the demand driven by the shipment of the new generation server platform was not as expected. In order to promote the growth of enterprise SSD revenue, the supplier expected to stimulate sales through more relaxed price negotiation. However, the buyer was not willing to expand the purchase volume for the time being, so it was estimated that the price of enterprise SSD would expand to 5-10% in the third quarter.

In terms of EMMC, the weak demand for major applications such as chromebook and TV makes the buyer carefully control inventory, so EMMC prices are still difficult to see signs of improvement. Although the original factory’s long-term plan will continue to reduce the supply of 2D EMMC products, and maintain price stability through supply reduction, recently with the comprehensive downward repair of demand, end customers and module customers focus on inventory removal, and the overall market situation is significantly oversupplied, which is more serious than expected, Therefore, the price of EMMC will fall by another 8-13% in the third quarter.

In terms of UFS, as the demand for smart phones did not benefit from 618 e-commerce promotion and recovered, the destocking of whole machine inventory has become a top priority for Chinese brand manufacturers, and the downturn in demand has not only impacted Chinese mobile phone brands, even Samsung, which is dominated by markets outside China, has also raised a warning of unclear demand prospects, resulting in the continued weakening of UFS market conditions in the second half of the year, and the original seller held the view that the price reduction could not stimulate demand, Unwilling to give in to the price, with the stock pressure rising, it is inevitable to reduce prices for sale. It is estimated that the UFS price decline in the third quarter will expand to 8-13%.

In terms of NAND flash wafer, it was originally estimated that the demand in peak season would bring running water to the market, but the demand continued to deteriorate, and the inventory status of module plants and end customers was still high, leading to the continuous decline of wafer quotation. At the same time, the original factory continues to expand the supply of wafer, and the process optimization also continues to improve, causing the original factory to bear great inventory pressure. It is estimated that the decline of wafer contract price in the third quarter will expand to 15-20% in the quarter.

Ps: when you need to quote the research content or analysis data provided by trendforce Jibang consulting in the report, please indicate that the source of the data is trendforce Jibang consulting.

Read more from trendforce: Q3 global chromebook computer shipment market share in 2020 (original data sheet attached) IDC: Q3 global chromebook shipments fell 29.8% year-on-year in 2021 Gartner: it is expected that personal computer shipments will decline by 9.5% in 2022, chromebook shipments will drop as high as 30% IDC: Q2 global chromebook shipments will reach 12.3 million units in 2021, with a year-on-year increase of 68.6% in 2020, chromebook sales worldwide will exceed macidc: tablet and chromebook shipments will reach 168.8 million units in 2021, with a year-on-year increase of 3.2% canalys: Q2 global chromebook shipments will reach 11.9 million units in 2021 Million units increased by 75% year-on-year. In 2020, the market share of chromebook exceeded that of maccanalys: in Q1 2022, the global PC shipment reached 118.1 million units, with a year-on-year decrease of 3% canalys: in 2021, the U.S. personal computer increased by 1%, and chromebook fell the most significantly. Omdia: in Q1 2021, the global chromebook shipment reached 10.93 million units, with a year-on-year increase of 369% NPD: chromebook’s education market share in the United States reached 40%, beating OS X and windowsgartner: it is expected that the sales of chromebook will reach 14.2 million units of wit in 2017 Sview: Global chromebook shipments reached 1.8 million in Q2 2014 canalys: Global chromebook shipments increased by 275% in Q1 2021

If you want to get the full report, you can contact us by leaving us the comment. If you think the information here might be helpful to others, please actively share it. If you want others to see your attitude towards this report, please actively comment and discuss it. Please stay tuned to us, we will keep updating as much as possible to record future development trends.

RecordTrend.com is a website that focuses on future technologies, markets and user trends. We are responsible for collecting the latest research data, authority data, industry research and analysis reports. We are committed to becoming a data and report sharing platform for professionals and decision makers. We look forward to working with you to record the development trends of today’s economy, technology, industrial chain and business model.Welcome to follow, comment and bookmark us, and hope to share the future with you, and look forward to your success with our help.