In the second half of 2022, the consumer MLCC demand continued to be weak, and the price may continue to fall by 3~6% From TrendForce

The following is the In the second half of 2022, the consumer MLCC demand continued to be weak, and the price may continue to fall by 3~6% From TrendForce recommended by recordtrend.com. And this article belongs to the classification: TrendForce.

Due to the volatility of the epidemic, the manufacturing industry is slow to return to work, and the short production gap caused by the epidemic in the second quarter is difficult to be filled by the ODM plant in the second half of the year. At present, the problem of high inflation leads to high prices, which does not help to support the demand in the peak season in the second half of the year. Among them, consumer products such as mobile phones, laptops, tablets and televisions have a significant impact, causing the demand for consumer MLCC to decline and the market inventory to rise. Trendforce Jibang consulting said that the average inventory level of all sizes reached more than 90 days, and it is estimated that the average price of consumer MLCC in the second half of the year may fall by 3~6%.

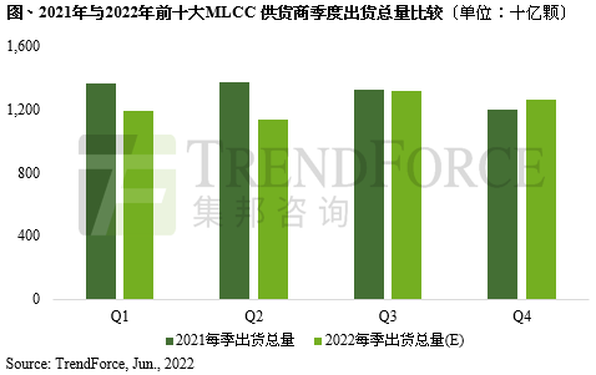

However, the demand for automotive, HPC high-speed computing (including servers), Netcom equipment, industrial automation, energy storage system equipment, etc. is still robust. Coupled with the slowdown in the demand for consumer products in the second half of the year, semiconductor IDM manufacturers are driven to gradually transfer their production capacity, which is expected to alleviate the IC shortage and support customers’ momentum of vehicle, industrial control and high-level MLCC. Trendforce Jibang consulting estimates that in the second half of the year, it is expected to drive the overall MLCC shipment to about 2580 billion, an increase of 2% compared with the same period last year, supported by the demand for automotive, server and Netcom products.

The consumption price and volume fell together, and the MLCC quotation of vehicle regulations and engineering regulations remained stable

According to the trendforce Jibang Consulting survey, from the first quarter of 2021 to the first quarter of 2022, the annual average price of consumer MLCC fell by 5~10%. In the second quarter of this year, in order to stimulate customers to increase their willingness to pull goods, the price of some low-level consumer MLCC has even touched the material cost. From the past MLCC supply and demand cycle process, the turning point of supply and demand often occurs after the continuous price and volume rise together, or after the price and volume fall together. For example, from the second half of 2020 to 2021, the price and volume rise together. Up to now, the volume and price have declined simultaneously for two consecutive quarters. In the second half of 2022, the pressure on the MLCC quotation of consumer regulations remained unabated, and it was feared that it would continue to decline. It was estimated that there would still be an average decline of 3~6%. On the contrary, the industrial regulation niche MLCC price is expected to increase the temperature of the driving force of goods pulling, with a decrease of 1~2%, or even flat, under the relief of the shortage of client chips. The vehicle regulation MLCC price, which belongs to the annual quotation, is expected to maintain a stable price and volume.

Shake off the fluctuation of consumer product market and expand the layout of various manufacturers

Murata and TDK have mastered nearly 80% of the MLCC market for vehicles. In addition to continuously expanding the production capacity for vehicles, they are also actively taking root in the MLCC parts application service, and further improving to the module application service through collaborative customer design, so as to improve customer adhesion. At present, the two suppliers have started to provide image sensor module, IPA module and other services in vehicle powertrain and ADAS advanced driving assistance system.

Samsung has also passed the verification of car factories this year. From the third quarter, it will gradually increase the car production capacity of Tianjin plant; Guoju is located in the Kaohsiung Daihatsu plant. It is expected to start production line verification in the fourth quarter, mainly expanding industrial high-voltage products and large-size products such as 0805 and 1210 for vehicles under 22u. It is expected to be mass produced by the end of the first quarter of 2023, with a monthly production capacity of about 8-10billion pieces at the initial stage. In addition, it also continues to expand the application of high-end products such as military industry, Netcom, vehicles and medical treatment through comprehensive services of MLCC, resistors, inductors and antenna modules.

Trendforce Jibang consulting believes that although the manufacturing industry in East China of Chinese Mainland has resumed operation one after another, Shanghai’s freight transportation to open sea and air ports is fully recovering, accelerating the shipment of ODM factory finished products. Under the condition that the logistics gradually returns to normal, the problem of long and short materials is expected to be greatly improved, thus boosting the momentum of the third quarter. However, global geopolitical conflicts, epidemics, high inflation or stagnant inflation will become the main variables affecting the MLCC market in the second half of 2022.

More reading: trendforce: in 2021, 4.844 billion mobile camera modules will be shipped, which will increase by 3% next year. Trendforce: in 2021, the total market share of the world’s top three base station equipment manufacturers will decrease slightly. Trendforce: it is estimated that the installed capacity of lithium iron phosphate batteries will account for 60% in 2024. Trendforce: it is estimated that the shipment of E-sports LCD monitors will be about 26.1 million in 2022, The annual growth rate converged to 14% trendforce: in 2021, the global shipments of notebook panels reached 282million trendforce: affected by the pollution of some materials in WDC and kioxia, In the second quarter, the price of NAND flash will increase by 5-10% trendforce: it is estimated that the shipment of mobile camera modules in 2022 will be about 4.92 billion trendforce: it is estimated that the demand for positive materials of power batteries will exceed 2.15 million tons in 2025 trendforce: the market share of global Gan power manufacturers’ shipments in 2021 trendforce: it is estimated that the price of memory will decrease by 3-8% in the fourth quarter of 2021 trendforce: provide relevant data for Apple’s presentation trendforce: the second quarter of 2021 The top ten IC designers in the world achieved a revenue of US $29.8 billion trendforce: in the second quarter of 2021, the global mobile phone production was only 307million units, a quarter decrease of 11% trendforce: the spot module price continued to weaken, and the PC DRAM contract price will fall by 0~5% in the fourth quarter trendforce: the virtual currency price fell sharply, weakening the overall market momentum of graphics DRAM in the third quarter

If you want to get the full report, you can contact us by leaving us the comment. If you think the information here might be helpful to others, please actively share it. If you want others to see your attitude towards this report, please actively comment and discuss it. Please stay tuned to us, we will keep updating as much as possible to record future development trends.

RecordTrend.com is a website that focuses on future technologies, markets and user trends. We are responsible for collecting the latest research data, authority data, industry research and analysis reports. We are committed to becoming a data and report sharing platform for professionals and decision makers. We look forward to working with you to record the development trends of today’s economy, technology, industrial chain and business model.Welcome to follow, comment and bookmark us, and hope to share the future with you, and look forward to your success with our help.