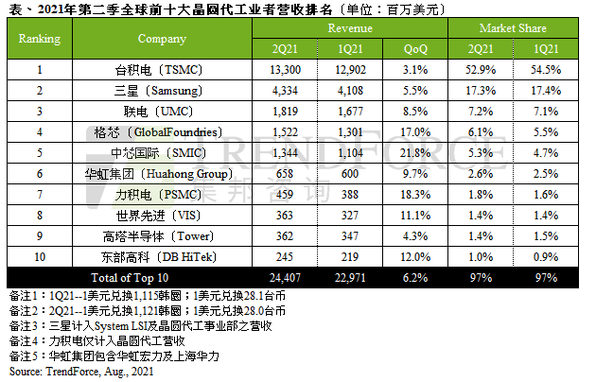

In the second quarter of 2021, the global foundry output value reached US $24.407 billion, with a quarterly increase of 6.2% From TrendForce

The following is the In the second quarter of 2021, the global foundry output value reached US $24.407 billion, with a quarterly increase of 6.2% From TrendForce recommended by recordtrend.com. And this article belongs to the classification: TrendForce.

According to trendforce Jibang Consulting survey, the panic stock tide caused by post epidemic demand, communication generation conversion, geopolitical risks and long-term shortage continued to burn in the second quarter. Due to the limitation of wafer foundry capacity, the stock strength of various terminal products that can not meet the shipping target did not fall, driven by the rising price of wafers in the first quarter, In the second quarter, the output value of wafer foundry reached US $24.407 billion, with a quarterly increase of 6.2%. It has reached an all-time high for eight consecutive quarters since the third quarter of 2019.

TSMC and Samsung were interrupted, and the quarterly growth of revenue was slightly limited

TSMC’s second quarter revenue reached US $13.3 billion, a quarterly increase of 3.1%, ranking first in the world. Its revenue growth was limited by the power outage in Nanke Fab14 P7 plant in April, resulting in the scrapping of a small number of 40nm and 16nm wafers; As well as the power failure of Xingda power plant in Kaohsiung of Taiwan Power in May, the wafer plant in Nanke was most directly impacted. Although the timely operation of generators in the plant prevented the online wafers from being scrapped, some 8-inch wafers still needed to be reworked. In addition, as TSMC maintained a consistent and stable quotation strategy, although the revenue performance in the second quarter was higher than the upper edge of the company’s financial guidelines, the quarterly growth rate was slightly lower than that of other wafer factories, and the market share was slightly eroded.

Samsung’s revenue in the second quarter was $4.33 billion, with a quarterly increase of 5.5%. After getting rid of the haze of the heavy snow in Texas in February, Samsung’s line S2 in Austin fully resumed production in early April, and made every effort to increase order production to make up for the plant’s film loss for nearly a month and a half. Although the sharp decline in the first quarter slightly affected the output in the second quarter, resulting in a slight limitation on the quarterly growth, the revenue performance was still bright driven by the strong sales of CIS, 5g RF transceiver, OLED drive IC and other products. UMC, which ranks third, is still driven by the demand of PMIC, tddi, Wi Fi and OLED driven IC. The capacity utilization rate has exceeded 100%, which is seriously in short supply. Therefore, it continues to raise the price of customers; In addition, 28 / 22nm new production capacity with higher prices was successively opened, driving the average selling price in the second quarter to rise by about 5%, pushing up the revenue to US $1.82 billion, with a quarterly increase of 8.5%, and the market share was roughly flat at 7.2%.

The second quarter revenue of global foundries increased by 17.0% to $1.52 billion, ranking fourth. After selling Fab10 from the United States and fab3e from Singapore to on semi and the world’s advanced in 2019, it gradually converged its product lines, focused on the development of 14 / 12NM FinFET, 22 / 12NM fd-soi, 55 / 40nm HV and BCD process technologies, and announced to expand the production capacity of the existing product lines, New plants are planned in the United States and Singapore respectively, and it is expected to contribute revenue from the second half of 2022 to 2023; Although Fab10 has been sold to ansenmey, the plant continues to manufacture products for on semi from 2020 to 2021, and will be handed over to ansenmey for independent operation until the delivery is completed in 2022. In the second quarter, the revenue of SMIC increased by 21.8% to US $1.34 billion, and the market share also increased to 5.3%. The main driving force comes from the strong demand for various processes including 0.15/0.18um PMIC, 55 / 40nm MCU, RF, HV and CIS, and also continued to increase the wafer price. In addition, the introduction progress of 14nm new customers is better than expected, and the 15kwspm capacity is currently in full load.

Huahong group’s consolidated revenue ranking jumped to sixth, surpassing tower semiconductor in the world

As both hhgrace and hlmc belong to Huahong group, they operate Fab1 / 2 / 3 / 7 and FAB5 / 6 respectively, and some manufacturing resources circulate with each other, so they are combined into Huahong group this time; In Wuxi, Huahong’s Fab7 production capacity expanded faster than expected, and customers from NOR flash, CIS, RF and IGBT were strong in pulling goods. At present, 48kwspm production capacity has reached full load operation. In addition, the capacity of 8-inch plant has maintained a growth rate of more than 100%, driven by the quarterly increase of 3-5% in the average sales unit price of wafers, the revenue of Huahong group increased by 9.7% in the second quarter, ranking sixth with us $660 million.

After surpassing tower in revenue ranking for the first time in the first quarter, PSMC maintained strong growth in the second quarter. P1 / 2 / 3 plants, including specialty DRAM, DDI, CIS and PMIC products, continued to inject; The demand for IGBT and other vehicles of 8A / B plant increased significantly. Driven by the quarterly rise in the overall price, the revenue reached US $460 million, with a quarterly increase of 18.3%, ranking seventh. Driven by a number of favorable factors such as the maintenance of demand for DDI, PMIC and power discrete, the opening of new capacity of fab3e in Singapore, the adjustment of product portfolio and the continuous increase of average sales unit price, the revenue of world advanced (VIS) surpassed tower semiconductor for the first time by 11.1% in the second quarter, reaching US $363 million.

The ninth ranked tower semiconductor (tower) has stable demand in rf-soi, industrial and vehicle PMIC fields, but limited by the fact that the new production capacity is not in place, its revenue increased only slightly by 4.3% in the quarter, and reached US $360 million in the second quarter. Eastern High Tech (dbhitek) has maintained the full load level for more than one and a half years. The demand for 8-inch PMIC, MEMS and CIS has made a stable contribution. Most of the increase in revenue comes from the increase of average sales unit price. The revenue in the second quarter was US $245 million, with a quarterly increase of 12.0%.

Looking forward to the third quarter, the shortage of foundry capacity has been burning for nearly two years since the second half of 2019. Although some new capacity has been opened one after another, due to the limited increase, the newly opened capacity has been booked from the perspective of orders. The capacity utilization rate of each foundry is generally maintained at the full load level and continues to be in short supply of capacity, In addition, since the second quarter of this year, with the promotion of governments around the world, the investment volume of car chips has been greatly increased and the capacity has been expanded. As a result, the average selling price of wafer foundry has continued to rise, and all factories have successively adjusted their product portfolios to improve their profitability. Therefore, trendforce Jibang consulting believes that the output value of the top ten wafer foundry in the third quarter will set a new record, and the quarterly growth rate will be better than that in the second quarter.

More reading: trendforce: it is estimated that the global wafer foundry output value will reach US $84.6 billion in 2020, with an annual growth of 23.7%. Trendforce: it is estimated that the global wafer foundry output value will reach 23.8% in 2020. Trendforce: in Q1, the total output value of the world’s top ten wafer foundry manufacturers will reach US $22.75 billion, a single quarter high. Trendforce: it is estimated that the market share of high-end notebook display panels will exceed 20% in 2022 : it is estimated that the sales volume of TVs in 2021 is expected to reach 223 million, with a year-on-year increase of 3.1%. Trendforce: it is estimated that the sales volume of global new energy vehicles will reach 4.35 million in 2021, with an annual growth rate of 49%. Trendforce: it is estimated that the quotation of NAND flash will continue to rise in the third quarter of 2021, and the overall contract price will rise by 5 ~ 10%. Trendforce: the revenue ranking of the world’s top ten IC designers in the first quarter of 2021. Trendforce: it is estimated that Apple iPho will be in 2021 NE production totaled 223 million trendforce: in the second quarter of 2021, the total revenue of the global NAND flash industry reached US $16.4 billion, with a quarterly increase of 10.8% trendforce: the quotation of laptop client SSD increased by 3 ~ 8% in the second quarter of 2021 trendforce: the total market share of the world’s top three base station equipment manufacturers decreased slightly in 2021 trendforce: the total output value of DRAM in the first quarter of 2021 reached US $19.2 billion, with a quarterly increase of 8.7% trendforce: NAND f in the first quarter of 2021 The total revenue of flash memory industry reached US $14.82 billion, with a quarterly increase of 5.1%. Trendforce: in the first quarter of 2021, the global TV shipment reached 49.96 million units, with a quarterly decrease of 24.2%

If you want to get the full report, you can contact us by leaving us the comment. If you think the information here might be helpful to others, please actively share it. If you want others to see your attitude towards this report, please actively comment and discuss it. Please stay tuned to us, we will keep updating as much as possible to record future development trends.

RecordTrend.com is a website that focuses on future technologies, markets and user trends. We are responsible for collecting the latest research data, authority data, industry research and analysis reports. We are committed to becoming a data and report sharing platform for professionals and decision makers. We look forward to working with you to record the development trends of today’s economy, technology, industrial chain and business model.Welcome to follow, comment and bookmark us, and hope to share the future with you, and look forward to your success with our help.