Data inventory of Weilai, ideal and Xiaopeng, three new forces of domestic car making in Q1 in 2021

The following is the Data inventory of Weilai, ideal and Xiaopeng, three new forces of domestic car making in Q1 in 2021 recommended by recordtrend.com. And this article belongs to the classification: New energy vehicle industry.

With the recent release of the first quarter of 2021’s unaudited financial report by ideal automobile, the Q1 financial report of the new auto making forces including Weilai automobile and Xiaopeng automobile has been released. With the booming domestic new energy market and Tesla’s slowing domestic growth momentum, what are the transcripts of the three new forces? What is the impact on the future?

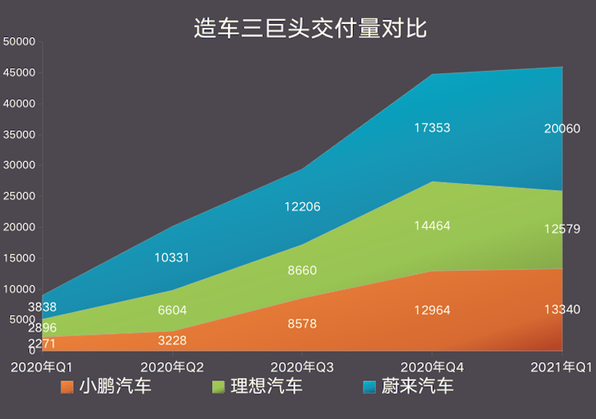

In the financial report, the most eye-catching is the delivery volume. According to the comprehensive data, Weilai’s Q1 delivery exceeded 20000 for the first time and continued to lead the way. Li Bin’s statement is also slightly proud: “at the beginning of 2021, Weilai set a new quarterly delivery record of 20060 vehicles in the first quarter, with a year-on-year growth of 422.7%.”

Xiao Peng can be described as “stable” in all aspects. The ideal delivery volume decreased by 13.03% on a month on month basis, and it is the only company with negative growth rate on a month on month basis among the three car manufacturers. At the same time, the financial report showed that the ideal Q1 turned into a loss after the profit was achieved in the last quarter. The net loss reached 360 million yuan, an increase of 366.9% year on year.

It is not difficult to see that the gap between the ideal car and the other two has not narrowed. At the same time, in the car boom, the market’s vision is also changing.

Growth slowdown: ideal Auto’s negative month on month growth and net loss expanded 366.9% year on year

Specifically, Q1 financial report showed that the ideal vehicle delivery volume was 12579, with a year-on-year growth of 334.4% and a month on month decrease of 13.03%; Xiaopeng delivered 13340 vehicles, a year-on-year increase of 487.4% and a month on month increase of 2.9%; Weilai delivered 20060 vehicles, a year-on-year increase of 422.7% and a month on month increase of 15.6%.

While the growth rate of the other two companies exceeded 400%, the ideal car was less than 350%, and the gap was further widened. In terms of month on month growth, only the ideal number was negative, reaching – 13.03%.

And this also directly affects the financial data of the big three.

According to the financial report, as of March 31, 2021, the total revenue of ideal automobile Q1 was 3.58 billion yuan (545.7 million US dollars), an increase of 319.8% compared with 851.7 million yuan in Q1 in 2020, and a decrease of 13.8% compared with 4.15 billion yuan in Q4 in 2020; The net loss of ideal automobile Q1 is 360 million yuan (54.9 million US dollars), while the net loss of Q1 in 2020 is 77.1 million yuan, an increase of 366.9% over the same period of last year, and the net income of Q4 in 2020 is 107.5 million yuan.

Xiaopeng’s total revenue in Q1 was 2.950.9 billion yuan (US $450.4 million), an increase of 616.1% compared with 412.1 million yuan in Q1 in 2020, and an increase of 3.5% compared with 2.851.4 billion yuan in Q4 in 2020. Xiaopeng had a net loss of 786.6 million yuan (120.1 million US dollars) in Q1, compared with 649.8 million yuan in the same period in 2020 and 787.4 million yuan in Q4 in 2020.

The total revenue of Weilai Q1 was 7.982.3 billion yuan (1.218.3 billion US dollars), 481.8% higher than that of 1.372 billion yuan in Q1 in 2020, and 20.2% higher than that of 6.641.1 billion yuan in Q4 in 2020. The net loss of Weilai Q1 was 451 million yuan (68.8 million US dollars), 73.3% less than that of Q1 in 2020 and 67.5% less than that of Q4 in 2020.

On the other hand, the ideal gross profit rate of Q1 in 2021 is 17.3%, while that of Q1 and Q4 in 2020 is 8.0% and 17.5% respectively; Xiaopeng’s gross profit margin in Q1 of 2021 is 11.2%, while that in Q1 of 2020 and Q4 of 2020 are – 4.8% and 7.4% respectively; Weilai’s gross profit margin in Q1 of 2021 is 19.5%, while that in Q1 of 2020 and Q4 of 2020 are – 12.2% and 17.2% respectively.

In addition, the continuous high investment in R & D is considered to be the main reason why the new force of car manufacturing has failed to achieve self-development. According to the financial report, the R & D investment of ideal, Xiaopeng and Weilai in Q1 this year is about 515 million yuan, 535 million yuan and 687 million yuan respectively, and the R & D expenses account for 14.41%, 18.13% and 8.61% of the overall revenue respectively.

Li Xiang, the founder, chairman and CEO of ideal automobile, said that in the future, he will increase investment in R & D, and the R & D cost will increase to 3 billion yuan in 2021.

By contrast, Tesla has been profitable for seven consecutive quarters. According to the financial report, Tesla Q1’s revenue was 66.151 billion yuan (US $10.389 billion), a year-on-year increase of 73.58%. Its revenue scale was about 18.5 times that of ideal car, 22.4 times that of Xiaopeng and 8.3 times that of Weilai; Q1’s net profit is 438 million US dollars, which is in sharp contrast with the big three.

As of March 31, 2021, the balance of ideal Auto’s cash and cash equivalents, restricted cash, time deposits and short-term investment is 30.36 billion yuan (US $4.63 billion); Xiaopeng was 36.201 billion yuan (US $5525.4 billion); Weilai was 47.5 billion yuan (US $7.3 billion).

Corner Overtaking: pay attention to side pressure when releasing new cars and expanding production capacity

Recently, Tesla’s continuous negative attitude, especially the rights protection of female car owners during the Shanghai auto show, including several subsequent safety accidents, has given a group of new car building forces the opportunity to overtake on the curve.

Just the day before the financial report was released, ideal car released 2021 ideal one models. The new car has been upgraded in vehicle configuration, mileage and automatic driving, and will be delivered on June 1 this year.

Recently, a suspected Shunyi district government information shows that ideal automobile will invest 6 billion yuan to take over a factory of Beijing Hyundai Shunyi base, relying on the original factory and land resources of Beijing Hyundai to build a global flagship factory of ideal automobile. The project is planned to be put into operation in 2023 and the industrial output value will reach 30 billion yuan in 2024.

To this afore-mentioned news, ideal car replies: did not receive news, do not comment.

At the 2021 Shanghai auto show, Xiaopeng automobile brought its third product, the world’s first mass-produced intelligent car equipped with lidar – Xiaopeng P5. It is understood that Xiaopeng P5 is expected to start delivery in the fourth quarter of 2021.

Recently, some media reported that Weilai may launch an entry-level sub brand. The first model is called “Gemini” in English and “Gemini” in Chinese. In addition, it has started the development of new models in Hefei, and its positioning will be lower than that of existing SUVs and cars. It plans to produce 60000 vehicles a year; This Gemini or Weilai car will be introduced as an entry-level model.

At present, the selling price of Weilai’s models is no less than 350000 yuan. Therefore, Weilai urgently needs to develop a main model with the main selling price of about 200000 yuan to explore a broader market and complement Weilai’s brand.

However, with the transformation of SAIC, BAIC, GAC, Dongfeng and other traditional automobile enterprises. In 2021, car making has almost become the standard configuration of science and technology enterprises. Huawei, Baidu, Xiaomi, Lenovo, 360, Didi, oppo, Skyworth, Gree and Midea have successively announced car making related news.

For the big three, there is no doubt a huge side pressure.

In April 2021, according to the sales data of the new force of car making, Nezha sold 4015 cars, following Weilai, ideal and Xiaopeng. In terms of growth rate, the growth rate was 23.7% on a month on month basis and 532% on a year-on-year basis, both ranking first among the new car making forces.

Cold in car building? Market value “cut”, institutional clearance hot money pouring into the field of segmentation

The complex and changeable market environment is finally reflected in the stock price. As of press release, the ideal share price is US $23.3 and the market value is US $21.078 billion; Xiaopeng’s share price was US $32.13, with a market value of US $25.783 billion; Weilai’s share price was $38.62, with a market value of $63.28 billion.

Among them, in terms of closing price, ideal has dropped 47.0% from the highest point of US $43.96, and its market value has evaporated by US $18.69 billion; Xiaopeng dropped 55.48% from the highest point of $72.17, and its market value evaporated $32.23 billion; Weilai fell 38.54% from its peak of US $62.84, and its market value evaporated US $39.685 billion.

So far, the market value of the three auto makers has almost halved compared with the high point, with a total evaporated market value of US $90.505 billion.

Cui Dongshu, Secretary General of the Federation, said in an interview with first finance that the whole new energy industry is expected to slow down, the capital bubble will ebb, and the stock price will gradually recede. Tesla is seen more as a technology company than as a car manufacturer. In addition to the proceeds from the sale of carbon credits, Tesla is still in a loss state, and the sales growth brought by the price reduction is not sustainable. Ideal also only achieve quarterly profit, the whole year is still in a state of loss. Xiaopeng’s sales growth slowed down. New energy vehicle enterprises are still in the stage of development. Compared with traditional vehicle enterprises, the market volume is small, and there is a certain amount of water in the valuation. “

With the expiration of the local government’s incentive policy for the consumption of electric vehicles, the further decline of the new subsidy amount, and the rise of chip prices caused by the “lack of core”, the cost of the new force of car manufacturing will rise, which will also affect its stock price.

While the stock prices of the big three are fluctuating, the institutions are clearing their positions.

On February 13, hillhood capital announced to the securities and Exchange Commission the position of US stocks at the end of the fourth quarter of 2020. According to the data, at the end of the third quarter of 2020, highland capital held about 2.41 million shares of Weilai, 1.6 million shares of ideal automobile and 900000 shares of Xiaopeng automobile. At the end of the fourth quarter of the same year, highland capital no longer held the equity of the new energy vehicle company.

At the same time, BYD confirmed that highland capital participated in the latest round of private placement of BYD shares with us $200 million, and it planned to participate in the subscription with a higher amount at the beginning.

This change also indicates that the capital market is looking for new opportunities outside the main engine plant.

Relevant statistical data show that there are 60 financing cases in the automatic driving industry in 2020, and the total amount of financing disclosed reaches 43.63 billion yuan, which is 136.8% higher than that of 18.42 billion yuan in 2019; In the first two months of this year alone, the number of investment and financing events in this industry has reached 24, and the total amount of investment and financing disclosed is 17.64 billion yuan.

Since 2021, autonomous driving related companies such as Wenyuan Zhixing, Yushi technology, Xiaoma Zhixing, Tucson future, Zhijia technology and chip companies such as horizon have continued to obtain a new round of financing.

Previously, new energy vehicles have been written into the government work report for seven consecutive years (in which the term “clean vehicle” was used in 2017), and it has been mentioned many times, which is the annual keyword of the automobile industry. In the government work report on March 5 this year, new energy vehicles were absent for the first time, but related charging piles, power stations and battery recycling were all included in the government work report.

It is reported that it is expected that in 2021, there will still be a number of car companies to join the promotion of power exchange, and “charging + power exchange” will become the two parallel modes in the future. The development mode and format of new energy vehicles will also show a more diversified trend.

Relevant analysts also said, “in the stage of pursuing high-quality development of new energy vehicles, vehicle manufacturers need to cooperate with external technology companies and Internet companies to achieve in-depth cooperation in software systems (auxiliary driving, on-board operating system), ‘three electric’ (battery, motor, electronic control), etc. Leading listed companies in the field of fine molecules still have a lot of room for development. “

More reading from liyun.com: comparison of financial reports of China’s new car making forces Weilai: gross profit margin of financial report of 3q20 is 14.5%; delivery of 5600 + second generation platform NT2 in Q4 is absolutely ahead of Li Bin; Weilai: revenue of 3q20 is 4.526 billion yuan, exceeding expectation Weilai: call conference record of 1q21 Weilai has no rival in the field of high-end vehicles Weilai: total revenue of 1q21 is about 7.982 billion yuan, with a year-on-year growth of 481.8%; Weilai: delivery of 3965 units in August 2020, doubling year-on-year, innovation again Gao Weilai: 3q20 financial report teleconference record is about to be released car Weilai: 2q20 teleconference minutes predict that Q3 will deliver 11000 units, rent battery mode will lower the threshold ride union meeting: Tesla’s new energy sales will be the first in May, Weilai and other new forces will become important forces in new energy vehicle market Weilai: the delivery volume in November 2020 will set a record again, double year-on-year for eight consecutive months Weilai: the delivery volume in December 2020 will exceed 7000 Total 43728 units delivered Weilai: sales increased by 352.1% year on year in January 21; 7225 units delivered reached a record high Weilai automobile: 17353 new vehicles delivered by 4q20, up 112% year on year

If you want to get the full report, you can contact us by leaving us the comment. If you think the information here might be helpful to others, please actively share it. If you want others to see your attitude towards this report, please actively comment and discuss it. Please stay tuned to us, we will keep updating as much as possible to record future development trends.

RecordTrend.com is a website that focuses on future technologies, markets and user trends. We are responsible for collecting the latest research data, authority data, industry research and analysis reports. We are committed to becoming a data and report sharing platform for professionals and decision makers. We look forward to working with you to record the development trends of today’s economy, technology, industrial chain and business model.Welcome to follow, comment and bookmark us, and hope to share the future with you, and look forward to your success with our help.