National new housing market report in January 2022 From 58 anjuke Real Estate Research Institute

The following is the National new housing market report in January 2022 From 58 anjuke Real Estate Research Institute recommended by recordtrend.com. And this article belongs to the classification: Chinese economy.

1、 Summary of this month

According to the data in January, the overall heat of the new housing market in key cities across the country has cooled, the heat of customers’ house viewing has decreased significantly month on month, the number of new housing projects in the market has decreased slightly month on month, significantly year-on-year, the average selling price has decreased slightly month on month, and the transaction scale has decreased significantly. From the perspective of policy, the real estate regulation in January has generally continued the tone of moderate relaxation since the fourth quarter of last year, and the pressure of market policy has been relieved. The downward trend of LPR has released more confidence to the market at the psychological level. The superposition effect of policies is being released continuously. It is expected that the market adjustment trend in February will continue, Some cities with strong demand support and cities with strong policy support will significantly accelerate the pace of market bottoming and recovery, and the market in March and April is still expected.

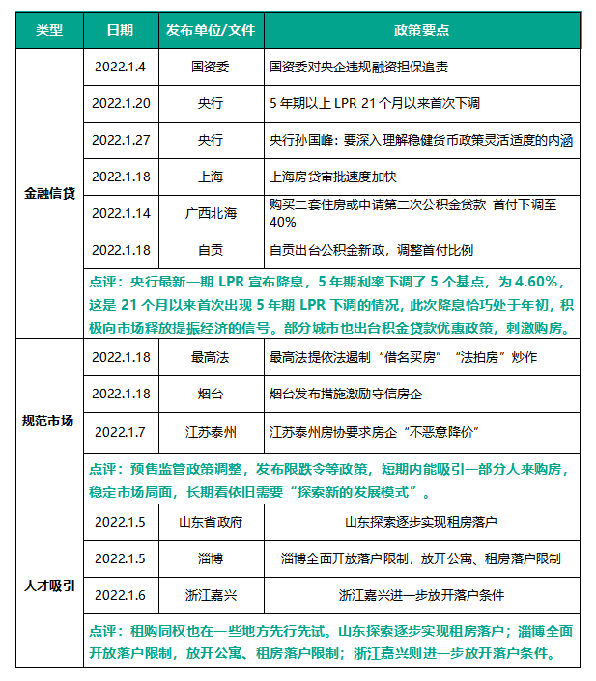

2、 Review of key policies for new houses

3、 Heat analysis

1. House viewing heat of customers in key cities

58 according to the data of anjuke Real Estate Research Institute, due to the approaching Spring Festival, the house viewing heat of customers decreased significantly in January. The house viewing heat of customers in key 65 cities decreased by 15.4% month on month, with a decrease of 5.4 percentage points over the previous month. It has fallen for five consecutive months since the house viewing heat turned down in September 2021. On a year-on-year basis, the house viewing heat has fallen sharply, Compared with January 2021, the decline rate reached 43%. Overall, the heat of house viewing in key 65 cities is cooling down.

2. Each echelon represents the house viewing heat of urban customers

In terms of different echelon cities, the house viewing heat of first tier, second tier and third tier cities decreased month on month in January. Among them, the second tier cities decreased the most, with a month on month decrease of 16.6%, followed by the third tier cities, with a month on month decrease of 13.4% and the first tier cities, with a minimum decrease of 11.6%. Compared with the same period of last year, the house viewing heat of each echelon city decreased significantly.

3. Each echelon represents the popularity of urban product visits

From the perspective of the visit popularity of the representative urban house types of each echelon, the most concerned house types in the first tier, second tier and third tier cities in January were three rooms. Among them, the visit popularity of three rooms in the third tier cities ranked first among all echelons, accounting for more than 51%, followed by the second tier cities, accounting for 48%; In terms of product area, 90-120 ㎡ and 120-150 ㎡ rigid demand and improved products are favored, of which 90-120 ㎡ and 120-150 ㎡ products in third tier cities account for more than 30%.

IV Number of items

1. Number and month on month trend of new housing projects in key cities

In January, the number of new housing projects in key 65 cities continued to decrease slightly, with a month on month decrease of 1.5% and a decrease of 1.2 percentage points compared with the previous month. On a year-on-year basis, the number of projects decreased by more than 10% compared with January 2021. With the recent moderate relaxation of regulatory policies and the obvious improvement of market confidence, it is expected that the pace of project deconvolution will accelerate in the next few months, and the number of new housing projects will continue to decrease.

2. Each echelon represents the trend of the number of new housing projects in the city

In terms of different echelon cities, the number of new housing projects in first tier, second tier and third tier cities continued to decrease month on month in January, and the decline was narrowed compared with the previous month. Among them, the third tier cities had the largest decline, with a decline of 1.7%, 1.8 percentage points narrower than the previous month; Followed by second tier cities, with a decline of 1.6%, 0.8 percentage points narrower than that of the previous month; First tier cities had the smallest decline, with a month on month decline of 0.8%, 1.5 percentage points narrower than that of the previous month.

V Price analysis

1. Average selling price and month on month trend in key cities

According to the monitoring data of 58 key cities of anjuke Real Estate Research Institute, in January 2022, the average selling price of 60 key cities in China decreased slightly compared with the previous month, with an average price of 17582 yuan / m2, a slight decrease of 0.15% month on month and a year-on-year increase of 1.4%. The average monthly selling price has not changed much in the past year, and the rise and fall of month on month have been stable within 1%. Among them, the average selling price in Shenzhen was 58873 yuan / m2, the highest in China, up 0.4% from the previous month. Under the guidance of urban policies, many cities and regions have opened the rhythm of moderate relaxation of regulation, especially the reduction of down payment will play an obvious role in increasing the heat of the real estate market. In addition, the marginal relaxation of financial policy has also played an obvious role in boosting market confidence. It is expected that the market adjustment trend in February will continue. In some cities with strong demand support and cities with strong policy support, the pace of market bottoming and recovery will be significantly accelerated. The market in the spring of March and April is still expected, and the selling price is expected to rise slightly.

2. Each echelon represents the trend of the city’s average selling price

In terms of the average selling price of representative cities of different echelons, the average selling price of first tier, second tier and third tier cities fluctuated slightly in January, of which the average selling price of first tier cities was 47083 yuan / m2, down 1.8% month on month, of which the increase of 0.5% in Beijing was the largest among first tier cities; The average price of second tier cities was 13808 yuan / m2, up slightly by 0.3% month on month, of which the average selling price in Hefei increased by 3.3% month on month, ranking the first in 60 key cities; The average price of third tier cities was 16725 yuan / m2, up slightly by 0.1% month on month.

3. Price map of new houses in key 60 cities in January

Note: the new house price is the monthly average of the quotation of the new house on sale on Anju customer line

4. Ranking list of average selling price of new houses in key 60 cities

6、 Transaction scale

1. Transaction area and month on month trend of key cities

As January 2022 is approaching the Spring Festival, the number of projects entering the market decreases, resulting in a significant decline in transactions in January. The transaction area of 53 key cities in China has decreased by 28.4% month on month. Compared with January last year, the decrease is more than 40%. The overall cooling of the market is very obvious.

2. Each echelon represents the trend of urban transaction area

From the perspective of representative cities of each echelon, the transaction area of first tier, second tier and third tier cities decreased significantly month on month in January. The transaction area of second tier cities was 15.38 million square meters, the largest decrease of 32.8%, followed by the decrease of 21.3% to 6.13 million square meters in third tier cities, and the decrease of 17.5% in first tier cities, among which the transaction volume of Beijing and Guangzhou decreased significantly, Shanghai’s trading volume increased significantly due to the centralized entry of the Sixth Batch of new stocks into the market.

Note: there are 53 key cities in the transaction data, including Beijing, Shanghai, Guangzhou and Shenzhen; The second tier includes 27 cities including Chengdu, Dalian, Fuzhou, Guiyang, Hefei, Hohhot, Jinan, Kunming, Lanzhou, Nanchang, Nanjing (including Lishui Gaochun), Nanning, Ningbo, Qingdao, Sanya, Xiamen, Shenyang, Shijiazhuang, Suzhou (including Wujiang), Tianjin, Wuxi, Wuhan, Xi’an, Changchun, Changsha, Zhengzhou and Chongqing, Mainly provincial capitals and cities specifically designated in the state plan; The third line includes Baoding

Changzhou, Dongguan, Foshan, Huzhou, Huizhou, Jiaxing, Kunshan, Liuzhou, Luoyang, Mianyang, Nantong, Nanyang, Quanzhou, Shaoxing, Wenzhou, Xuzhou, Yantai, Yancheng, Zhongshan, Zhuhai and Zibo are 22 cities, mainly prefecture level cities. More reading: 58 anjuke Real Estate Research Institute: the real estate market in 70 cities showed signs of recovery in January 2022, and the new house prices in first tier cities stabilized and rebounded. 58 anjuke Real Estate Research Institute: the real estate market during the Spring Festival in 2022 was significantly weaker than that in the same period last year. 58 anjuke Real Estate Research Institute: in October 2021, the construction area of 65 cities nationwide was 158.36 million square meters, down 15% month on month. 58 anjuke Real Estate Research Institute: summary of the real estate market in 2020 (download attached) 58 anjuke Real Estate Research Institute: house price map of national popular cities in January 2022 58 anjuke Real Estate Research Institute: National anjuke index report in October 2019 58 anjuke Real Estate Research Institute: national second-hand housing market depth report in November 2021 58 anjuke Real Estate Research Institute: the average listing price of second-hand houses in Beijing, Guangzhou and most second tier cities decreased month on month in November 2021 58 anjuke Real Estate Research Institute: 2021 Review of property market policies in and outlook for 2022 (with download) 58 anjuke Real Estate Research Institute: property market report of the third quarter of 2019 (with download) 58 anjuke Real Estate Research Institute: summary of the property market in the first half of 2020 (with download) 58 anjuke Real Estate Research Institute: May 2021 national rental market report 58 anjuke Real Estate Research Institute: July 2021 national anjuke index report 58 anjuke Real Estate Research Institute: July 2021 national rental report 58 anjuke Real Estate Research Institute: October 2021 national new house monthly report

If you want to get the full report, you can contact us by leaving us the comment. If you think the information here might be helpful to others, please actively share it. If you want others to see your attitude towards this report, please actively comment and discuss it. Please stay tuned to us, we will keep updating as much as possible to record future development trends.

RecordTrend.com is a website that focuses on future technologies, markets and user trends. We are responsible for collecting the latest research data, authority data, industry research and analysis reports. We are committed to becoming a data and report sharing platform for professionals and decision makers. We look forward to working with you to record the development trends of today’s economy, technology, industrial chain and business model.Welcome to follow, comment and bookmark us, and hope to share the future with you, and look forward to your success with our help.