Top 10 global semiconductor suppliers in 2021 From IC Insights

The following is the Top 10 global semiconductor suppliers in 2021 From IC Insights recommended by recordtrend.com. And this article belongs to the classification: IC Insights.

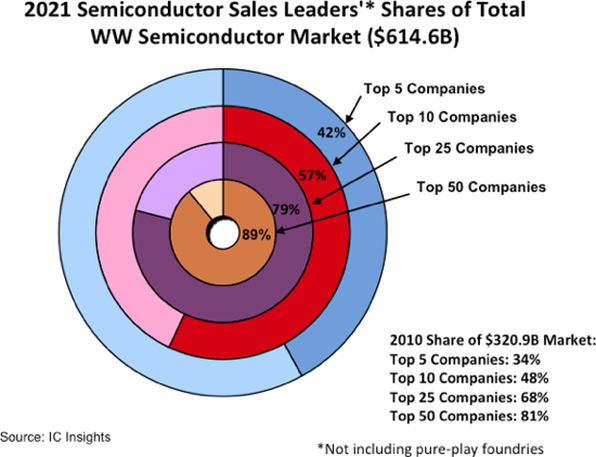

In 2021, the top 50 semiconductor suppliers excluding pure foundry accounted for 89% of the global total semiconductor market of US $614.6 billion, an increase of 8 percentage points over the 81% share of the top 50 companies in 2010.

In 1993, Intel became the No. 1 supplier with a 9.2% share of the global semiconductor market. In 2017, Intel’s sales accounted for 13.9% of the entire semiconductor market. In contrast, Samsung’s share of the global semiconductor market was 3.8% in 1993 and 14.8% in 2017.

In 2019, the memory market fell sharply, reducing the entire semiconductor market by 12%. As 77% of Samsung’s semiconductor sales that year were memory devices, the sharp decline in the memory market dragged down Samsung’s total semiconductor sales by 29%. Although Intel’s semiconductor sales were relatively flat in 2019, the company regained its first position as a semiconductor supplier that year. But in 2021, Samsung’s sales increased by 33%, while Intel’s sales increased by only 1%.

In addition to the foundry, there are two new companies entering the top 10 in 2021, MediaTek and AMD. The two companies replaced apple and Infineon in the top 10 in last year’s ranking. MediaTek’s sales increased by an astonishing 61%, making the company rise three places in the ranking, from 11th to 8th; AMD’s sales increased by 68% in 2021, rising from 14th to 10th.

In 2021, five of the top 10 semiconductor suppliers were fabless, an increase of two over 2019. In the 2008 ranking, there was only one fabless factory, namely Qualcomm; Not in 2000.

In 2021, the sales of the top ten companies reached more than US $16.4 billion. As expected, in view of the possible acquisitions and mergers in the future, the top ten ranking may change significantly in the next few years, and as the semiconductor industry continues to move towards maturity.

More reading: IC insights: it is expected that the proportion of semiconductors in electronic systems will drop to 26.4% in 2019. IC insights: global semiconductor sales will increase by 24% in 2021. IC insights: it is expected that semiconductor device shipments will exceed 1 trillion pieces in 2021, a record high. IC insights: it is expected that global IC shipments will reach 427.7 billion pieces in 2022, a year-on-year increase of 9.4% IC insights: it is expected that global semiconductor sales will reach US $680.6 billion in 2022, an increase of 11% IC insights: 2020 In the first half of the year, the global semiconductor sales ranked among the top 10 manufacturers. IC insights: in 2020, the global semiconductor manufacturers ranked first. IC insights: in 2017, the semiconductor M & a transaction volume reached US $27.7 billion. IC insights: it is expected that the global semiconductor sales will reach US $680.6 billion in 2022, an increase of 11%. IC insights: in 2018, the global semiconductor shipments will exceed US $1 trillion. IC insights: in 2017, Samsung will surpass Intel to become the largest chip manufacturer IC Insights: in 2026, China accounted for 8.8% of the global OEM market. IC insights: in 2021, 17 Companies in the world had semiconductor sales of more than US $10 billion. IC insights: ranking of global semiconductor growth rate in 2013: Hynix first MediaTek was second to Qualcomm. IC insights: the top ten semiconductor companies with capital expenditure in 2014

If you want to get the full report, you can contact us by leaving us the comment. If you think the information here might be helpful to others, please actively share it. If you want others to see your attitude towards this report, please actively comment and discuss it. Please stay tuned to us, we will keep updating as much as possible to record future development trends.

RecordTrend.com is a website that focuses on future technologies, markets and user trends. We are responsible for collecting the latest research data, authority data, industry research and analysis reports. We are committed to becoming a data and report sharing platform for professionals and decision makers. We look forward to working with you to record the development trends of today’s economy, technology, industrial chain and business model.Welcome to follow, comment and bookmark us, and hope to share the future with you, and look forward to your success with our help.