In 2021, the overall market shipment of inkjet and laser printer consumables in China was nearly 94.345 million, with a year-on-year increase of 1.4% From IDC

The following is the In 2021, the overall market shipment of inkjet and laser printer consumables in China was nearly 94.345 million, with a year-on-year increase of 1.4% From IDC recommended by recordtrend.com. And this article belongs to the classification: IDC.

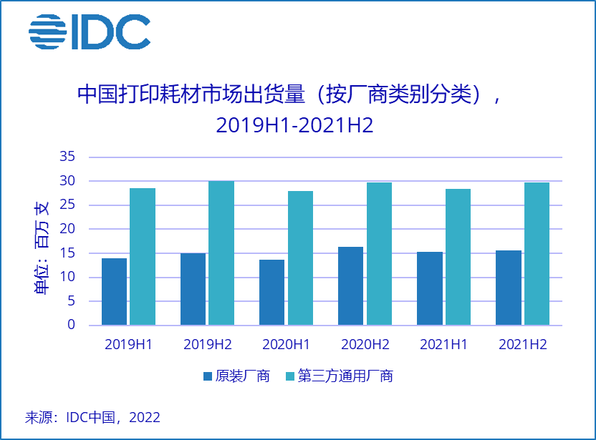

According to the latest research of IDC’s annual tracking report on China’s printing consumables market, the total shipment volume of China’s inkjet and laser printer consumables market in 2021 was close to 94.345 million, with a year-on-year increase of 1.4% in 2020. Among them, the annual growth rate of inkjet consumables market has reached 3.6%, and the structural change of inkjet market is becoming more and more obvious. The total ownership of continuous supply large ink warehouse series printer products has maintained a growth rate of 20.9%, thus driving the shipment of bottled ink to maintain a double-digit growth, reaching 25.8%. On the one hand, it shows that continuous supply products are recognized by more consumers and commercial output users relying on their subversive cost-effective advantages; At the same time, the overall supply of ink cartridge products is insufficient this year, and the overall supply of ink warehouse products is stable, which is also an important factor in the growth of bottled ink. The five-year compound growth rate of the laser printer market has reached 3.3%, which makes the overall laser printing consumables still maintain a positive growth of 0.6% year-on-year in 2021. However, it is undeniable that the digital transformation is vigorously promoting the trend of paperless office, and the long-term growth of printing volume will be a negative factor.

For the overall domestic printing consumables market, IDC China has the following views:

1. Inkjet Market: the original ink cartridge has recovered its lost ground, the third-party ink cartridge market is moving away, and the continuous supply is still advancing rapidly

According to the current IDC research data, ink cartridges are still the mainstream in the inkjet printing market. This is mainly because mainstream brands such as HP and Canon are still relying on ink cartridge inkjet printers to occupy the market share advantage. In particular, there is still a huge demand for ink cartridge products in the consumer market, which continues to drive the growth of the number of ink cartridge machines. Although the mainstream manufacturers had the shortage caused by production capacity and regional distribution in 2021, the overall annual shipment of original ink cartridge consumables still reached 13.413 million, a slight decrease of 3.6% year-on-year in 2020; In contrast, in the third-party general ink cartridge market, due to the technical upgrading of the original ink cartridge technology and the increase of the production cost of general consumables, the profit of the third-party general ink cartridge products continues to decline, which has been unable to meet the profit expectation of large-scale production. Therefore, in addition to the long-term accumulated brand awareness, the head general manufacturers can also determine the production on demand. Most small and medium-sized general manufacturers have to choose strategic transformation and focus on the laser consumables market.

According to IDC data, the compound growth rate of shipments of third-party general-purpose ink cartridges in the past five years is – 11.7%, indicating that the overall general-purpose ink cartridge enterprises are still insufficient in coping with technological innovation and product upgrading; The ink warehouse type continuous supply products, with their stable supply and more economical printing cost, have won more consumption and industry users. With the stable growth of ownership, both the original and general bottled ink market have the potential of rapid growth.

IDC data show that the compound growth rate of ink bottle shipment of ink bin printer in the past five years has reached 12.9%. The rapid growth of large ink bin series inks has boosted the confidence of the overall inkjet consumables manufacturers, which has a great impact on the development pattern of inkjet consumables market in the future.

2. Laser Market: the original selenium drum is tenacious, the general laser consumables are strong, and the domestic brand has become a new bright spot

Original packaging and general motors are the two camps in the domestic laser printing consumables market. After more than 20 years of development, today we see that the market share of General Motors laser consumables has increased from 37.6% 15 years ago to 77.9% (IDC monitoring data), which has become the first choice of laser printing products in the domestic consumer and industrial market. On the one hand, this great change comes from the success of domestic head brands such as gezhige and Tianwei in technological innovation, quality improvement and market promotion; On the other hand, it also relies on the support of domestic policies and the pull of the general priority policy vigorously implemented by the government and state-owned enterprises, which has rapidly turned the general market, which was slightly disordered in the past but has great potential, to the development track of improving brand influence and standardized operation.

The original toner cartridge continues to carry out technological innovation and launch products that meet the needs of the domestic market, such as low volume and continuous powder supply. At the same time, it promotes the multi scene application solutions of traditional flow models and color printers. Its high-quality printing experience and perfect after-sales service still have a strong attraction to users in the industry. IDC data show that although the general consumables brand has achieved strong development in various fields, the compound annual growth rate of original toner cartridges has maintained a growth rate of 2.3% in the past five years.

In the limited growth, we found that domestic brands have increased significantly in both consumer and commercial markets. The core brand is bentu. It has been more than 10 years since the first domestic printer was released. It has developed into the top five mainstream brands in the overall laser printer market, and its laser consumables have achieved a remarkable compound annual growth rate of 27.7% in the past five years, Its strong driving force of independent innovation and large-scale production, coupled with the guidance of national policies, makes it a star brand in the laser printing consumables market with international brands.

To sum up, Huo Yuanguang, senior analyst of IDC China peripherals products and solutions department, believes that the domestic printing consumables market has developed to a mature stage and is undergoing the in-depth integration of enterprise digital transformation, intelligent commerce, smart office and traditional office printing applications. On the one hand, we should accept the negative impact of efficiency first paperless office on printout; At the same time, we should also see that the total number of complete machines in the consumables market supporting the huge printing demand is still growing steadily. The growth of ownership comes from the number of small and medium-sized enterprises occupying the mainstream of the market, the fast-growing market segments, innovative printing solutions, and the fast-growing home market, which requires international mainstream manufacturers and domestic emerging printer brands, in the current era of digital economy and intelligent commerce, Only by continuously innovating the printing mode and deepening the application solutions of printing output in various industries, and meeting the needs of users for multi-function, multi scene and high cost performance, can we bring new business opportunities to enterprises and lead the long-term sustainable development of the printing industry.

More reading: IDC: in 2021, the total shipment volume of China’s inkjet and laser printer consumables market was close to 94.345 million, with a year-on-year increase of 1.4% IDC: in 2019, the total shipment volume of China’s overall printer consumables reached 95.856 million IDC: in the second quarter of 2021, the global Smartphone shipment volume was 313 million, with an increase of 13.2% IDC: in 2020, the market revenue of Q3 global enterprise external OEM storage system was 6.8 billion US dollars Year on year decline of 1.4% IDC: it is estimated that the global shipment of smart home devices will reach 854 million units in 2020, with a year-on-year increase of 4.1% IDC: the global sales of wearable devices will reach 72.6 million units in Q1 in 2020, with a year-on-year increase of 29.7% IDC: the sales of 124 million smart phones in India in 2017, with a year-on-year increase of 14% IDC: the number of printed paper will reach 2.8 trillion pages in 2020, with a year-on-year decrease of 14% IDC: it expenditure in 2012 is expected to increase by only 6% and that in China 14% IDC: Apple’s share in China fell below 10% in Q3 in 2012, ranking No. 6 Flurry: Apple accounted for 51.3% of the devices activated in the Christmas week. IDC: in the fourth quarter of 2021, the shipment volume of China’s printing peripheral market was 4.942 million, a year-on-year decrease of 10.3% IDC: the scale of the global AI market reached US $432.8 billion in 2022, an increase of nearly 20% IDC: the global shipment volume of foldable mobile phones reached 7.1 million in 2021 IDC: the whole world in 2022 The global AI market reached US $432.8 billion, with a year-on-year increase of nearly 20%

If you want to get the full report, you can contact us by leaving us the comment. If you think the information here might be helpful to others, please actively share it. If you want others to see your attitude towards this report, please actively comment and discuss it. Please stay tuned to us, we will keep updating as much as possible to record future development trends.

RecordTrend.com is a website that focuses on future technologies, markets and user trends. We are responsible for collecting the latest research data, authority data, industry research and analysis reports. We are committed to becoming a data and report sharing platform for professionals and decision makers. We look forward to working with you to record the development trends of today’s economy, technology, industrial chain and business model.Welcome to follow, comment and bookmark us, and hope to share the future with you, and look forward to your success with our help.