From January to September 2020, the accumulated revenue of Japanese mobile game market accounts for one fourth of the global total From Sensor Tower

RecordTrend.com is a website that focuses on future technologies, markets and user trends. We are responsible for collecting the latest research data, authority data, industry research and analysis reports. We are committed to becoming a data and report sharing platform for professionals and decision makers. We look forward to working with you to record the development trends of today’s economy, technology, industrial chain and business model.Welcome to follow, comment and bookmark us, and hope to share the future with you, and look forward to your success with our help.

The following is the From January to September 2020, the accumulated revenue of Japanese mobile game market accounts for one fourth of the global total From Sensor Tower recommended by recordtrend.com. And this article belongs to the classification: Mobile games.

The Japanese market occupies a special position in the history of the game industry. This is the hometown of head console manufacturers such as Nintendo, SEGA and Sony, as well as the birth of many world-famous game IP. There is no doubt that Japan has always been an important part of the global game market. In recent years, the mobile game industry in Japan is still developing rapidly.

$1 billion product

Puzzle & Dragons, launched by gunho online entertainment in 2012, is one of the first free mobile games in the world that has exceeded the total revenue of US $1 billion. Monster strike, launched by mixi in 2013, has since achieved this success. Since January 2014, the two games have generated a total of $13.7 billion in revenue.

In addition, Japanese games with revenue exceeding $1 billion include fate / grand order developed by Sony’s Aniplex company, Dragon Ball Z: dokkan battle by Bandai Namco and Disney Tsum by line Corporation.

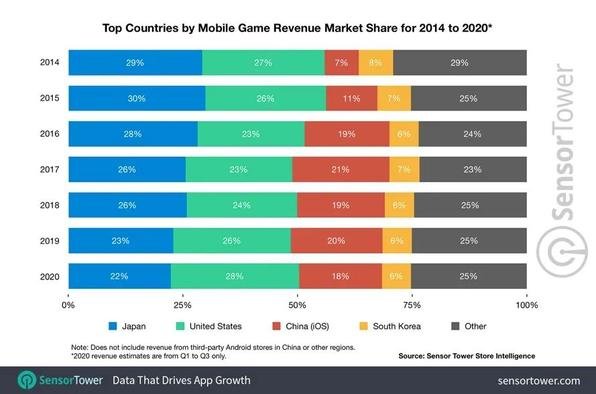

As early as 2014, Japan’s mobile game market generated $5.6 billion in annual revenue, accounting for 29.2% of the total global player spending on Apple’s app store and Google play platform. The Japanese market then peaked in 2015, accounting for 30% of global revenue.

With the rise of the U.S. and Chinese markets, Japan’s mobile game market’s total revenue has dropped to 23% in 2019, but it is still close to a quarter of the global total; the total revenue has also reached a new record of $14.5 billion in 2019. From 2014 to 2018, the Japanese market always ranked first in the global apple and Google play game market bestsellers, and was not overtaken by the United States until the third quarter of 2019 and 2020.

Local Games dominate

In terms of revenue, local manufacturers still dominate the Japanese market. During the period from January 1, 2016 to September 30, 2020, eight of the top 10 best-selling mobile games in the Japanese market came from local manufacturers, and seven of them generated more than $1 billion in revenue during that period. Pok é mon go, also in the top 10, was developed by American manufacturers, but its IP also came from Japan.

Two of the top ten global game makers with the highest sales volume between January 1 and September 30, 2020 are from Japan. Among them, Bandai Namco has $1.5 billion in revenue and square Enix has $1.2 billion in revenue. Sony, Konami and mixi are also among the top 20 best sellers in the world.

This means that in the first three quarters of 2020, Japanese publishers accounted for a quarter of the world’s top 20 mobile game company bestsellers. In contrast, China has five distributors in the top 20, and Chinese companies such as supercell and playtica have also performed well.

In 2019, the revenue of Japan’s top 10 overseas best-selling games (calculated by overseas market revenue) exceeded US $1 billion for the first time, with a year-on-year increase of 3%; the international market revenue increased by US $25 million, accounting for 2.1% of the global mobile game revenue of apple and Google play stores (excluding the Japanese market). Up to now, the total revenue of Japan’s top 10 overseas best-selling games in 2020 has reached 8145 million US dollars, accounting for 1.7% of the global revenue excluding the Japanese market.

In the international market, there are two Japanese mobile games occupy the leading position. Dragon Ball Z: dokkan battle achieved a record revenue of $273.6 million in the overseas market in 2019, while the annual revenue of fate / grand order in overseas market reached 273.3 million US dollars.

Although the year-on-year growth rate of Japanese mobile game market dropped to single digit for the first time in 2019 (4% year-on-year), the total revenue increased by 583 million US dollars to 14.5 billion US dollars last year. At present, the growth rate of the world’s major mobile game markets is slowing down. Japan also needs to wait patiently for the arrival of the next development opportunity. More reading: Q2 Japanese mobile game market trends and Chinese manufacturers’ market share in 2019 pocket gamer & Sensor Tower: global mobile games weekly, 19-25 August 2019 41% and more than 50% of the paid mobile game players in Japan are reluctant to declare cyberz: in 2013, the scale of mobile games in Japan was $5.4 billion, accounting for 50% of the game market? MMD: 2014 survey report on the utilization of mobile games in Japan zebra.com: the survey shows that 41% of the attraction of mobile games in Japan comes from the pictures. Looking back on the first half of 2014, the advertising revenue of mobile games in Japan will increase again. D2c: advertising and effect analysis of mobile games in Japan

If you want to get the full report, you can contact us by leaving us the comment. If you think the information here might be helpful to others, please actively share it. If you want others to see your attitude towards this report, please actively comment and discuss it. Please stay tuned to us, we will keep updating as much as possible to record future development trends.