Penetration of electric vehicles is expected to rise to 57% in 2030 From Credit Suisse

RecordTrend.com is a website that focuses on future technologies, markets and user trends. We are responsible for collecting the latest research data, authority data, industry research and analysis reports. We are committed to becoming a data and report sharing platform for professionals and decision makers. We look forward to working with you to record the development trends of today’s economy, technology, industrial chain and business model.Welcome to follow, comment and bookmark us, and hope to share the future with you, and look forward to your success with our help.

The following is the Penetration of electric vehicles is expected to rise to 57% in 2030 From Credit Suisse recommended by recordtrend.com. And this article belongs to the classification: New energy vehicle industry.

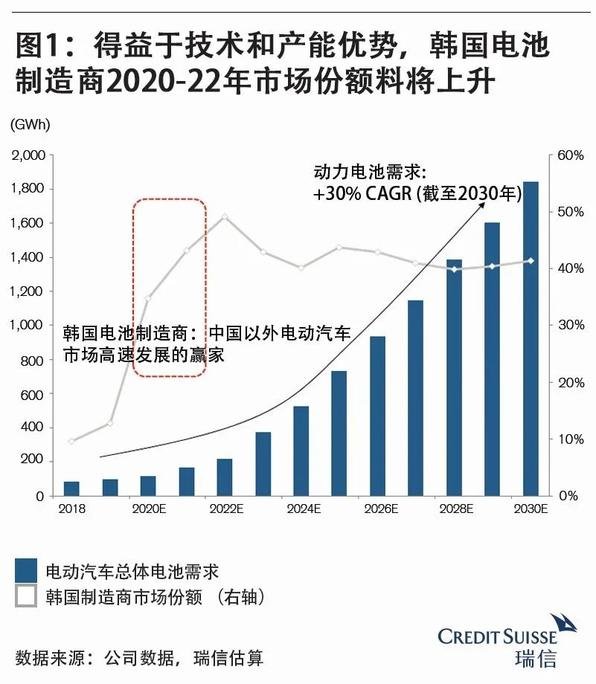

Credit Suisse recently released a research report, raising the demand forecast of electric vehicle power battery. Due to the tightening of carbon dioxide emission standards, Credit Suisse automotive industry research team will increase the expected penetration rate of electric vehicles from 45% to 57% in 2030. Meanwhile, due to the upgrading of battery technology, Credit Suisse assumes that the unit energy density increases from 62 kwh to 72 kwh. Based on these two factors, Credit Suisse raised the demand of electric vehicle power battery in 2030 from the original forecast of 1.5 TWH to 1.8 TWH, with an average annual compound growth rate of 30%.

Credit Suisse analysts believe that battery manufacturers’ technical and capacity advantages will help their bargaining power. Although concerns about Tesla battery have risen since then, even if some auto manufacturers produce their own batteries, the demand for power batteries is still at an early stage, and high-quality battery manufacturers still have enough room for growth.

Credit Suisse believes that in the current early growth stage, the bargaining power of the first tier battery manufacturers relative to most automobile OEMs will be enhanced, which is attributed to:

Technical advantages (accumulation in chemical / manufacturing processes) enable battery manufacturers to produce high energy density batteries at lower cost

Capacity is ready, marginal capital expenditure burden is declining, and material waste is reduced

The supply market for high-quality power batteries is being consolidated, while the market for automotive OEMs and battery materials is still fragmented.

Credit Suisse analysts preferred Korean battery manufacturers. With the help of competitive advantages in battery technology, Korean battery manufacturers rapidly expand their market share and constantly improve their customer portfolio, so they are favored by Credit Suisse analysts. Non Korean battery manufacturers are less popular because of the possible decline in market share or greater pricing pressure. Credit Suisse is still bullish on most battery material companies, as diversified purchasing by battery manufacturers will squeeze their profit margins.

More reading: Weilai: 2q20 telephone conference minutes expected to deliver 11000 rental batteries in Q3 IEA: overview of global electric vehicles in 2018 China electric vehicle 100 people’s meeting: Research on electric vehicle travel in rural China (version 2.0) cinaev100 & NRDC: Research Report on the business prospect of electric vehicle and power grid interaction (download attached) insideevs: global sales of electric vehicles will reach 2.21 million in 2019 Tesla 368000 Toyota: electric vehicle globalization strategy report in 2019 Accenture: global electric vehicles will reach 10 million in 2025 Alert to overcapacity of power battery in China Guojin Securities: a series of in-depth reports on Tesla industry

If you want to get the full report, you can contact us by leaving us the comment. If you think the information here might be helpful to others, please actively share it. If you want others to see your attitude towards this report, please actively comment and discuss it. Please stay tuned to us, we will keep updating as much as possible to record future development trends.