Report on the operation of chain supermarkets in 2021 From CCFA

The following is the Report on the operation of chain supermarkets in 2021 From CCFA recommended by recordtrend.com. And this article belongs to the classification: Life data, research report.

The report on the operation of chain supermarkets (2021) was released a few days ago. Based on the survey data of China chain operation association, the report combs the development of supermarket formats in 2020.

2020 is a special year when COVID-19 disrupts the normal order of production and life. In the epidemic, supermarket enterprises overcame many difficulties, insisted on normal business, and achieved sales growth while undertaking corporate social responsibility.

In 2020, the sales scale of the top 100 supermarkets was 968 billion yuan, a year-on-year increase of 4.4%, and the total number of stores was 31000, a year-on-year increase of 7.4%. Among them, large supermarkets (6000m2 and above) account for about 14.4% of the total number of stores, supermarkets (2000-6000m2) account for about 12.3%, and community supermarkets (less than 2000m2) account for about 73.3%. Most of the new stores are community stores close to the community and mainly engaged in fresh food.

In 2020, sales will be from high to low, and maintain positive growth throughout the year. In the first half of 2021, due to the high base formed during the epidemic last year, the repeated epidemic and the impact of community group purchase, the store passenger flow and the same store revenue decreased, and the growth of revenue and profit was under pressure.

The main points of the report are as follows:

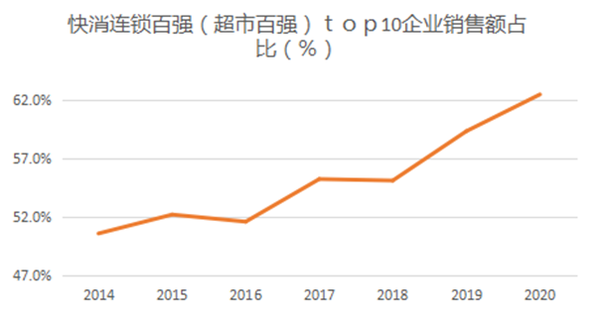

The head enterprises are still developing rapidly, and the concentration is further rising

The number of top 100 supermarket sales and stores still maintained positive growth, but the growth rate slowed down. The top 10 FMCG chain top 100 enterprises (the enterprises listed in 2019 were adjusted to supermarket enterprises, and the name of the list was also changed to supermarket top 100 enterprises), accounting for 62.5% in 2020.

1. Differentiation of enterprise profitability

The overall gross profit margin of the sample supermarket increased by 1.1 percentage points from 17.9% in 2019 to 19.0%. Due to rigid expenses such as epidemic prevention and protection and overtime subsidies, the net profit margin decreased from 1.2% to 1.1%. Compared with the distribution of gross profit margin and net profit margin in 2019, the differentiation between them has increased. The average net profit margin of western enterprises and enterprises with sales less than 1 billion decreased significantly.

2. Differentiation of urban performance and segmentation of business types

In 2020, the growth of comparable sales in the same store of supermarket enterprises slowed down as a whole, with an average growth rate of 4.1%, mainly from the third tier cities. The comparable sales of large supermarkets and supermarkets in the same store perform best in the third tier cities, and community supermarkets perform best in the fourth tier cities. From the perspective of subdivided formats, supermarkets and community supermarkets grew rapidly, and supermarkets grew the slowest.

1. Store type adjustment, from large customer gathering stores to small convenience stores

China’s supermarket format has formed a pattern of large supermarket + supermarket + community supermarket. Large supermarkets and supermarkets occupy the core business district, covering 5-20 and 3-5 kilometers of business district. Community supermarkets are close to residential areas, covering 1-3 kilometers of business district, filling the gap and weak sales areas. Each enterprise also configures various types of stores with different sizes and functional positioning according to the characteristics of the business district and property in the city. From the survey data of supermarkets, more and more new stores in physical supermarkets are transforming to small community stores mainly engaged in fresh food, with an area ranging from two or three hundred square meters to one or two thousand square meters, with an average area of about 900 square meters. At present, 70% of the top 100 enterprise stores in supermarkets are small community stores.

2. Positioning adjustment, from one-stop purchase to quality life satisfaction of specific people

1) Supermarket brand positioning refinement

Meet the needs of different customer groups through the difference setting of store area, commodity structure, decoration style and matching of supporting facilities. For example, China Resources Vanguard has successively launched vanguard mart, vanguard city and other innovative business brands according to disposable income, age, region and other factors; Focusing on the concepts of “city quarter hour convenient life circle” and “community, neighborhood and home”, combined with the characteristics of community supermarkets, Zhongbai group refines the customer base, vigorously optimizes the commodity structure, and introduces new stores such as affordable fresh food stores, z-era youth stores and neighborhood life stores.

2) Member store development and large-scale store member store transformation

From universal one-stop shopping to quality life satisfaction for members. At present, the member store operates in two forms in China, one is the paid member as the service object, represented by Sam, Costco and Metro plus, and the other is the non paid member store represented by Yonghui. Both of them improve the customer attraction capacity and customer unit price of stores by streamlining commodity SKUs, accurately positioning customer groups, and increasing the proportion of private brand commodities. From the existing feedback, the sales performance of stores after the transformation of large supermarkets has been improved.

3. Category adjustment

With the refinement of store positioning, the category structure, specifications and sales quantity of stores are also adjusted. The most obvious change is the increase in the number of 3R commodities and private brand commodities.

1) Expand 3R products

With the miniaturization of families, the proportion of one person households and two person households is close to 50%, and the economy of cooking at home is weakening day by day. 3R products well meet the convenience needs of consumers for the production of three meals. While increasing the proportion of 3R commodities, retail enterprises have also increased catering related services. First, directly sell the products with SC certification as commodities, and increase the category width and depth of 3R products; Second, associate with catering enterprises, and catering enterprises provide catering services in stores; Third, invite the chef of the restaurant to make on-site production to improve the smoke and experience; Fourth, self built restaurants in stores.

2) Strengthen private brand goods

In 2020, the top 100 supermarket enterprises have an average of nearly 900 private brand goods, accounting for 4.3% of sales, and the number of commodity SKUs and sales share continue to grow. Among domestic retailers, Yonghui, Wal Mart (including Sam’s club store), China Resources Vanguard, Metro, Wumart, HEMA, RT mart, Carrefour and other enterprises are at the forefront of the industry in terms of private brands, but most small and medium-sized retailers are still in the exploratory and wait-and-see stage.

2020 is a special year for every country. Although the spread of the epidemic around the world has a certain time lag, the problems faced by chain retail enterprises focusing on food sales in various countries are the same: they have experienced the problems of manpower shortage and rapid growth of online orders, and their final performance exceeded expectations. Under the background of the country’s rapid resumption of work and production, Chinese retail enterprises have experienced difficulties, but they have stronger toughness and more stable development.

More reading: CCFA: China’s top 100 supermarkets in 2019 CCFA & Zhejiang Business Research Institute: changes in the era of life service industry, Chain empowerment is ready to go (download attached) PricewaterhouseCoopers & CCFA: the capital road of Chinese chain catering enterprises CCFA & ncbd: Research Report on the retail situation of prepackaged food of brand catering enterprises (download attached) CCFA & meituan: 2021 China’s catering franchise industry white paper CCFA: 2021 New Tea Research Report CCFA & hungry: 2020 New Tea Research Report CCFA: analysis of digital application of life service chain enterprises CCFA & nielseniq: consumer insight report of China’s shopping centers from 2020 to 2021 TMI & CCFA: 2020 digital franchise franchise franchise franchise investor portrait and Behavior Research Report CCFA: 2020 retail CCFA: 2021 chain brand private domain operation white paper (with download) love Analysis & CCFA: 2021 China shopping center digitization trend report (with download) KPMG & CCFA: challenges and opportunities of Omo model of education chain enterprises (with download) CCFA & PricewaterhouseCoopers: 2019 KPI benchmarking research report of Chinese retail enterprises (download attached)

If you want to get the full report, you can contact us by leaving us the comment. If you think the information here might be helpful to others, please actively share it. If you want others to see your attitude towards this report, please actively comment and discuss it. Please stay tuned to us, we will keep updating as much as possible to record future development trends.

RecordTrend.com is a website that focuses on future technologies, markets and user trends. We are responsible for collecting the latest research data, authority data, industry research and analysis reports. We are committed to becoming a data and report sharing platform for professionals and decision makers. We look forward to working with you to record the development trends of today’s economy, technology, industrial chain and business model.Welcome to follow, comment and bookmark us, and hope to share the future with you, and look forward to your success with our help.