2021-2025 global wafer capacity From IC Insights

The following is the 2021-2025 global wafer capacity From IC Insights recommended by recordtrend.com. And this article belongs to the classification: IC Insights.

IC insights recently released its new global wafer capacity 2021-2025 report, which analyzes and forecasts the capacity of the global semiconductor industry by wafer size, region and product type by 2025.

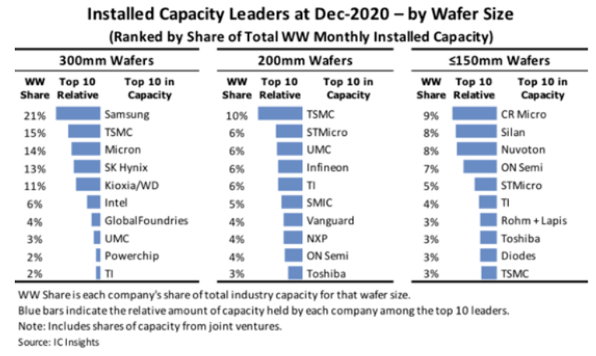

The report shows that as of December 2020, among the three wafer size categories, only TSMC ranked in the top. Last year, the company had the largest 200mm wafer capacity, ranking second in 300mm wafer capacity, second only to Samsung (as shown below):

In the field of 300mm wafers, DRAM and NAND flash memory suppliers such as Samsung, micron, SK Hynix and kioxia compete with TSMC, in addition to Intel, lattice core, Texas Instruments, etc; These companies are used to using the largest wafer size to amortize the manufacturing cost of each chip to the greatest extent.

They also have the ability to continue to invest heavily in the capacity of the new 300mm wafer plant. Some pure wafer foundries and manufacturers focusing on analog / mixed signal and microcontroller products are at the forefront of the wafer capacity in the 200mm size category.

The ranking of smaller wafer size (≤ 150mm) includes more kinds of companies, including two Chinese companies: Cr micro and Silan microelectronics. Both of them have 150mm wafer factories with strong capacity, which are mainly used to produce analog / mixed signals, power devices and discrete semiconductors.

STMicroelectronics used to have 150 mm wafer factories in Singapore, but the company has adjusted its business scope in Singapore in recent years. One of the production lines was restructured on a large scale to manufacture MEMS based microfluidic products (such as inkjet heads, chip laboratory equipment, etc.), while other wafer factories were upgraded to 200mm wafer projects.

As the industry shifts chip manufacturing to larger wafer factories, the overall number of chip manufacturers will continue to decline. The global wafer capacity study shows that as of December 2020, 63 companies have operated 200mm wafer plants (as shown in the figure below). 28 companies own and operate 300mm wafer plants.

In addition, among these manufacturers, the distribution of 300mm wafer capacity is the most important, and the five largest manufacturers hold about three-quarters (74%) of the global 300mm chip capacity.

More reading: IC insights: Huawei Hisilicon has fallen out of the top 15ic insights: it is expected that the global semiconductor sales will reach US $680.6 billion in 2022, with an increase of 11%. IC insights: the global IC market will reach US $565.1 billion in 2022. IC insights: the global semiconductor market will increase by 22% year-on-year in 2022. IC insights: Samsung will become the largest semiconductor supplier IC insi with us $833.1 billion in 2021 IC insights: the total amount of IC M & A transactions in the first eight months of 2021 reached US $22 billion. IC insights: the year-end inventory of the revenue of the top 25 semiconductor companies IC insights: the revenue of the top 15 global semiconductor manufacturers in Q1 reached US $101.863 billion in 2021, with a year-on-year increase of 21%. IC insights: Huawei Hisilicon fell out of the top 15 in the global semiconductor ranking in Q1 in 2021. IC insights: the fastest-growing ten types of chips in 2021 IC insights: it is expected that the shipment of semiconductor devices in 2021 will exceed 1 trillion, a record New high IC Insights:2020 Global Semiconductor R & D expenditure of $68 billion 400 million, an increase of 5%IC Insights:2020 year, the global IC chip production scale of 143 billion 400 million U. S. dollars, China accounted for 15.9%IC Insights:2025 year, Chinese mainland semiconductor chip output value will reach 223 billion dollars, IC Insights:2021 year, global semiconductor sales will grow 24%

If you want to get the full report, you can contact us by leaving us the comment. If you think the information here might be helpful to others, please actively share it. If you want others to see your attitude towards this report, please actively comment and discuss it. Please stay tuned to us, we will keep updating as much as possible to record future development trends.

RecordTrend.com is a website that focuses on future technologies, markets and user trends. We are responsible for collecting the latest research data, authority data, industry research and analysis reports. We are committed to becoming a data and report sharing platform for professionals and decision makers. We look forward to working with you to record the development trends of today’s economy, technology, industrial chain and business model.Welcome to follow, comment and bookmark us, and hope to share the future with you, and look forward to your success with our help.